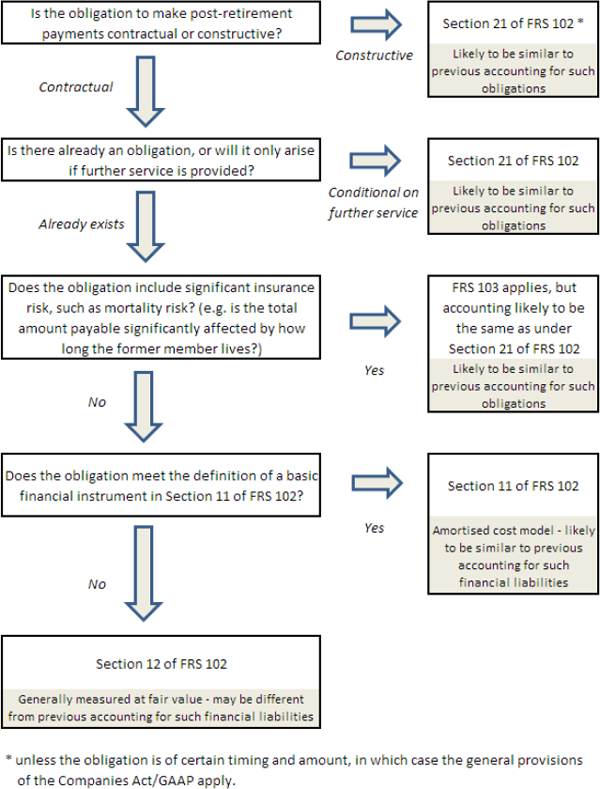

| 76. | LLPs should analyse their contractual or constructive obligations (including any relating to early retirement options) to make payments to members in their capacity as members at and after the point of their ceasing to be members of the LLP, between: |

| those that meet the definition of an insurance contract and, therefore, fall within the scope of FRS 103 Insurance Contracts; |

| those that give rise to financial liabilities falling within the scope of section 11 Basic Financial Instruments of FRS 102; |

| those that give rise to financial liabilities falling within the scope of section 12 Other Financial Instruments Issues of FRS 102; and |

| those that give rise to non-financial liabilities of uncertain timing and amount falling within the scope of section 21 Provisions and Contingencies of FRS 102. |

| In the case of an unconditional contractual obligation that meets the definition of an insurance contract, this will fall within the scope of FRS 103. As explained further in paragraph 80A, this will be the case where, for example, the total amount payable by the LLP may be significantly affected by how long the former member lives. |

| In the case of an unconditional contractual obligation to deliver cash or other financial assets, this will give rise to a financial liability and will fall within the scope of either section 11 or section 12 of FRS 102 unless it meets the definition of an insurance contract. In the case of a constructive obligation of uncertain timing or amount, or a contractual obligation that is conditional on further service from a member, any obligation for past service will fall within the scope of section 21 of FRS 102. |

| In the case of a constructive obligation of certain timing and amount, this will fall to be accounted for as a liability under the general provisions of the Companies Act/GAAP. |

| 76A. | The required accounting and disclosures will differ depending on whether an obligation falls within the scope of FRS 102 or FRS 103 and, if the former, depending on whether the obligation falls within the scope of section 11, section 12 or section 21.15 |

| FRS 103 allows entities, generally, to continue with their existing accounting policies for liabilities within its scope, while permitting limited improvements to those policies. |

| Section 11 of FRS 102 requires liabilities within its scope to be measured at amortised cost using the effective interest method. |

| Section 12 of FRS 102 generally requires liabilities within its scope to be measured at fair value. |

| Section 21 of FRS 102 requires liabilities within its scope to be measured at the best estimate of the amount required to settle the obligation at the reporting date, and gives further guidance on how this is to be determined.16 |

| 76B. | The flowchart below summarises how to determine which guidance applies to a particular obligation. Further guidance on the matters summarised is included below the flowchart. |

|

| 77. | Payments by an LLP to members after they have retired, often referred to as annuities, can take many different forms. It will be necessary to examine the nature of the contractual or constructive obligations in order to determine the governing accounting requirements. |

| 78. | Annuity payments may be either 'pre-determined' or 'profit-dependent'. |

| 'Pre-determined' annuity payments are amounts payable that are fixed at the time of retirement, for example, by reference to historical earnings (such as a percentage of the final year's profit share) or fixed at an amount, which may be index-linked or linked to a measure independent of the LLP's future profit. The period for which they are payable may or may not be pre-determined. The payment of the retirement benefit is thus not dependent on the LLP earning profits in the post-retirement period. |

| 'Profit-dependent' annuity payments are amounts payable to former members that are, in effect, a share of the LLP's on-going profits, by way of a preferential first share, profit points, profit-dependent bonus or some other mechanism. Many different arrangements exist, and there may be no amount payable in a year in which no or insufficient profits are earned. |

| 15 As an accounting policy choice, paragraph 11.2 of FRS 102 allows that, rather than applying the recognition and measurement provisions of sections 11 and 12, an entity can choose to apply either (1) the recognition and measurement provisions of IAS 39 Financial Instruments: Recognition and Measurement or (2) the recognition and measurement provisions of IFRS 9 Financial Instruments (together with those provisions of IAS 39 that have not yet been superseded by IFRS 9). In all cases, the disclosure requirements of sections 11 and 12 continue to be applicable. |

| 16 This approach is similar to that previously required by FRS 12 Provisions, Contingent Liabilities and Contingent Assets. |

|

|

Licence and copyright | © 2018, LexisNexis Group a division of Reed Elsevier (UK) Ltd. All rights reserved. |