Changes to the UK's Controlled Foreign Company Rules

The UK, like many other countries, has specific rules to prevent UK tax being deferred/reduced through recognising profits in low taxed subsidiaries. These rules, the controlled foreign company (CFC) legislation, have been substantially revised, after a long consultative process. The new rules apply to accounting periods beginning on or after 1 January 2013 and operate by reference to the accounting period of the CFC rather than the UK controlling company.

They represent a significant change to the way that the UK CFC regime operates. The aim is to better reflect the way that business functions in a global economy.

In addition, the legislation aims to improve the UK's competitiveness by only charging UK tax on foreign profits artificially diverted from the UK. This can be contrasted to equivalent legislation in some countries which can treat all passive income (for example, interest, royalties, rent) as ‘bad’ income for the purposes of their CFC rules.

Below is an overview of the new legislative framework. The detailed provisions can be complex and their application will need to be considered carefully depending on the facts and circumstances of each group.

Framework

A CFC is a company which:

- is resident outside the UK, and

- is controlled by UK resident persons (there is a very wide definition of control, which has been strengthened by the new legislation)

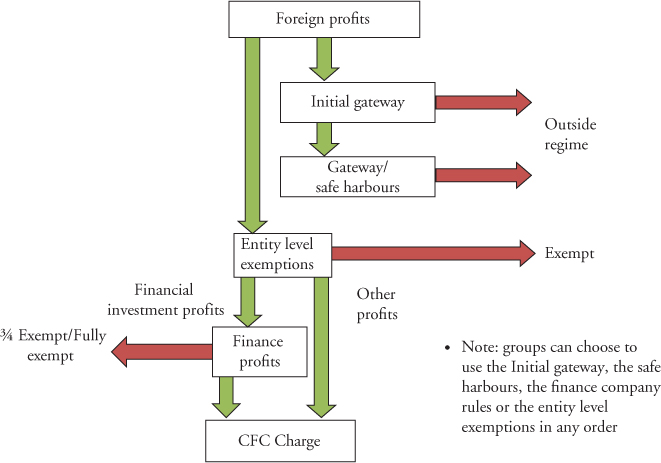

There are various exemptions which can apply to the CFC at an entity level or to a particular source of its income (see below). Capital gains and rental income are completely excluded from the regime.

If, after applying these exemptions, there is any income that is not taken out of account, it is apportioned to those UK corporate members that have at least a 25% interest in the CFC.

Exemptions – Entity Level Exemptions and the Gateway

The entity level exemptions and Gateway can be applied in any order. Therefore, groups can apply the most straightforward first, which should allow them to minimise their CFC compliance burden.

Appendix 1 sets out in diagrammatic form how the regime operates.

The Gateway / Initial Gateway

(i) The Initial Gateway

The purpose of the Initial Gateway is to allow groups to identify whether or not they are within the scope of the rules without the need to carry out the more detailed analysis and calculations required by the remainder of the legislation. It is therefore aimed at the more obvious situations.

The Initial Gateway for business profits (i.e. for groups outside of the financial services industry, broadly trading profits excluding interest income) consists of three conditions:

- Non-tax motive – broadly, if UK or overseas tax is reduced as a result of the arrangement it would have still taken place absent the tax saving;

- No UK activities – the CFC has no assets or risks that which are managed from the UK; or

- Independence – even if there is a UK connection through UK managed assets or risks, the CFC has the capability to carry on its business if the UK managed assets or risks were to stop being UK managed.

- The CFC's assumed total profits consist solely of either or both non-trading financing profits and property business profits.

If the CFC meets any one of the above conditions, its business profits will not pass through the Initial Gateway and are therefore out of scope.

In respect of interest income and similar profits (‘finance profits’), the Initial Gateway is not passed, and the CFC rules do not apply, if either of the following conditions is met:

- Incidental finance income – the CFC's finance profits are no more than 5% of its ‘profits’ so it is incidental to the activity of the CFC. The measure of ‘profits’ depends upon the activity of the CFC; or

- The CFC's finance profits arise from the investment of funds held for the purposes of an exempt trade or property business. The rules are intended to encompass cash retained for day-to-day working capital requirements and ongoing capital expenditure.

(ii) The Gateway

The Gateway performs a similar function to the Initial Gateway; it seeks to identify profits artificially diverted from the UK. However, as the second step in the process, the more obvious situations are excluded by the Initial Gateway. The Gateway requires a more detailed analysis to be undertaken. The associated compliance could be unappealing to some groups and reliance on an entity level exemption could provide a more straightforward exclusion from the CFC rules.

There are different Gateway chapters in the legislation, which each deal with a specific source of income (for example, a trading profits Gateway, a finance profit Gateway etc).

However, the chapters are not mutually exclusive and each must be considered.

To determine if business profits pass through the Gateway, it is necessary to identify the significant people functions (‘SPFs’) in relation to the assets and risks that are owned/borne by the CFC.

SPFs is a concept used for determining the profits attributable to a permanent establishment. For many groups this would be something they have not needed to previously consider and, unless the position is obvious (in which case it would be expected that it wouldn't pass through the Initial Gateway), this could be a significant compliance burden.

Profits will pass through the Gateway and become chargeable to the extent that they relate to SPFs in the UK. This is subject to a number of exclusions, including:

- UK activities are a minority of total activities;

- Substantial non-tax benefits are delivered to the CFC group through holding assets and risks offshore;

- It is reasonable to suppose that the arrangements would have been entered into by two independent companies in the same way, and those arrangements would have the same commercial effect;

- Trading profits “safe harbour” – all trading profits are excluded if five conditions, many of which require limited UK connection, are met.

A similar process is required for financial profits. Such profits will pass through the Gateway and potentially become chargeable if, broadly:

- There are associated UK SPFs;

- If any of the funding comes from the UK;

- If the loan has been made in lieu of a dividend; or

- If the profits arise from a finance lease to the UK.

Entity Level Exemptions

There are several entity level exemptions that groups can choose to apply as an alternative to the Gateway or the finance company provisions (see below). If one of the exemptions can be applied, all of the CFC's profits will be out of scope. As already stated, the legislation is not prescriptive about the order in which the exemptions are applied and an entity level exemption could be the most straightforward exemption for some groups to apply.

Many of the exemptions are carried over from the existing rules but, in the main, the relevant conditions have been relaxed.

(i) Excluded Territories Exemption

This exemption applies if the CFC is resident in one of the territories set out in the secondary legislation in the relevant accounting period. These are territories which HMRC believe the tax base and tax rate is sufficiently similar to the UK.

In addition to being resident in one of the listed territories, the CFC's total income from a number of categories of income must not exceed 10% of the company's adjusted pre-tax profits for the accounting period (or £50,000 if greater). These categories generally cover income which is exempt from tax or subject to a reduced rate of tax in the territory of residence. The exemption will not apply if a significant part of the CFC's intellectual property has been transferred to it from the UK in the previous six years.

(ii) Low Profits Exemption

There is a low profits exemption based on accounting profits and another based on taxable profits. Both apply the same financial limits, being:

- Profits are no more than £50,000; or

- Profits are no more than £500,000 and investment income is no more than £50,000.

(iii) Low Profit Margin Exemption

This exemption applies to exempt CFCs making a low level of profit by reference to their costs. A safe harbour of 10% of the CFC's ‘relevant operating expenditure’ is available. This exemption is likely to be of limited benefit, but could take some companies, for example, certain service companies, outside of the regime. It is aimed at those CFCs that perform substantial (in terms of volume) but relatively low value added functions outside the UK e.g. back-office functions, local marketing and distribution operations, or call or data processing centres.

(iv) The Tax Exemption

The exemption is available where the local tax paid in the CFC's territory in respect of the CFC's local chargeable profits is at least 75% of the corresponding UK tax, computed under UK tax principles.

(v) Temporary Period Exemption

Unusually, this exemption is less helpful under the new regime compared to the existing rules. The temporary period exemption is intended to reduce the CFC compliance burden associated with the acquisition by a UK group of an overseas subsidiary, or a move to the UK by a non-UK group.

A temporary period exemption of 12 months (three years under the previous rules) is available subject to the necessary restructuring taking place. The CFC must not have a CFC charge in the period following the exempt 12 month period i.e. it must be able to qualify for an exemption or have no chargeable profits that pass through the Gateway.

Finance Company Exemptions

These provisions provide full or partial exemption for profits arising from ‘qualifying loan relationships’ (broadly, loans made to connected foreign companies other than those made to UK permanent establishments, non-resident landlords or connected UK companies). The finance profit provisions are applied on a loan-by-loan basis and will commonly result in a very low level, or no UK tax on finance profits.

(i) Full Exemption

There are various conditions that need to be met to qualify for the full exemption. The most important of these is that the loan is made out of ‘qualifying resources’. The primary purpose of this requirement is to prevent groups from increasing their borrowing in the UK to fund a CFC which could otherwise take advantage of the full exemption.

The requirements for full exemption to apply could involve a significant tracing exercise. In practice it may initially be difficult for groups to obtain the necessary evidence.

(ii) Partial Exemption

The partial exemption is far more straightforward than the full exemption. Partial exemption is available via a claim where the CFC has ‘qualifying loan relationships’ (see above) and premises in its territory of residence. There is no requirement for the loans to be funded out of ‘qualifying resources’.

Under the partial exemption only 20% of a company's qualifying loan relationship profits will be apportioned to the UK. Ultimately, this will result in an effective UK tax rate of 5.5% on these profits when the mainstream rate of corporate tax falls to 22% in April 2014.

Applying the Rules

The new CFC regime represents a significant change.

The aim of the new rules is to move towards a more territorial system so that only foreign profits artificially diverted from the UK are subject to a CFC charge. This should broadly benefit existing groups.

In addition, the new rules could make it more attractive for groups to migrate into the UK. These groups may currently have nothing in the UK and, in such situations; the application of the UK CFC rules should be straightforward. Obviously, over time the position would need to be monitored.

Finally, the finance company rules may prove attractive to many groups.

Steven Stewart is Tax Manager with Deloitte UK.

Email: stestewart@deloitte.co.uk

Tel: +44 2890 531172

Glenn Roberts is Tax Partner, also with Deloitte UK.

Email: gleroberts@deloitte.co.uk

Tel: +44 2890 531136

Appendix 1

The Revised UK Controlled Foreign Company rules