Revenue Tax Briefing Issue 5, -

Introduction of Revised VAT Return of Trader Details (VAT RTD) Screens in ROS and Associated Measures

Introduction

All registered VAT traders are required by VAT Regulation 24(1) of the VAT Act to submit an annual Return of Trader Details (VAT RTD) form. The current format of the VAT RTD was introduced by Revenue in the early 1990’s as part of an administrative simplification process.

The VAT RTD form provides fields for a breakdown of the VAT exclusive value of the supply of goods and services, imports and deductible inputs at the various rates applicable during the year. This includes all Irish, Intra-EU and overseas trade.

With mandatory e-filing applying to 98% of VAT-registered traders, the VAT RTD is made available in ROS for the vast majority of traders and agents. A small number of paper RTDs are currently issued by the Collector-General, particularly in circumstances where the submission of an RTD is requested outside of the correct filing period.

1. Upcoming VAT RTD Reforms

Revenue has noted the concerns of traders and agents that the current RTD Form is relatively complex, is not intuitive and may generate confusion during completion.

For this reason, as initially notified in eBrief 31/13, over the coming year a number of operational measures and system improvements will be delivered to simplify the filing of the RTD and to encourage compliance with VAT RTD filing obligations.

The redevelopment will be delivered in a number of distinct stages:

Stage 1: Commencing on 1 September 2013, in accordance with S. 960H (2)(b) Taxes Consolidation Act 1997, taxpayers who are seeking repayments or refunds of tax may be requested by their local Revenue District to submit outstanding VAT RTD forms in order for such repayments or refunds to issue;

A revised VAT RTD format will be implemented in ROS with effect from 29th November 2013.

The following Section describes the revised RTD format in ROS in greater detail.

2. New VAT RTD Format

On November 29th 2013, a simplified VAT RTD template will be implemented in ROS.

The new format is designed to be highly user-friendly to electronic-filers, and features a number of expandable data fields which require completion only if the user indicates that they are relevant to that business. Accordingly, the administrative burden is minimised as the completed form is effectively tailored by the user to match the activities of the business.

The revised design will provide greater detail on the activities of businesses. It does not, however, require any information which is not required in the current format.

The following steps should be followed to select and submit an RTD in ROS:

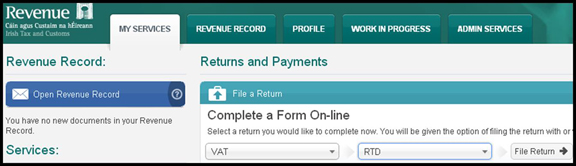

Step 1: In the "My Services" screen, select the "VAT RTD" option followed by "File Return"

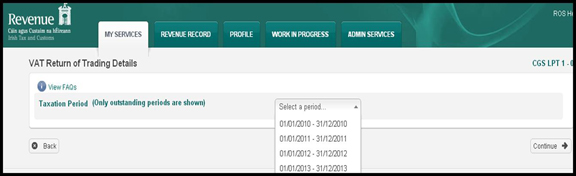

Step 2: - Select a period from the drop down menu and click the Continue button

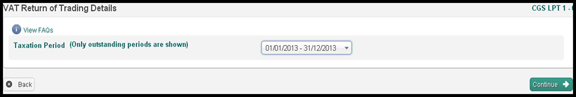

Step 3: Select the Taxation Period of the VAT RTD to be filed

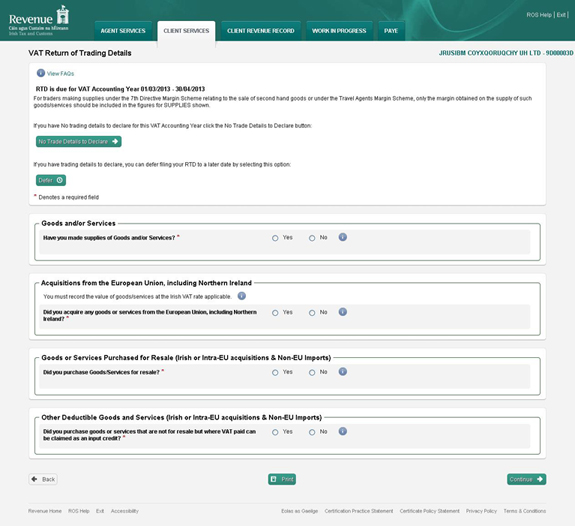

Step 4: In the VAT RTD detail screen there is an option to declare that there are “no trading details to declare” for the period selected at Step 3.

A second option to "Defer" the submission of the VAT RTD is also available. This function is provided to facilitate users who wish to complete the RTD and the VAT 3 Returns at separate times.

Users should note, however, that any subsequent failure to submit the RTD will represent a breach of statutory filing obligations and may lead to compliance action by Revenue.

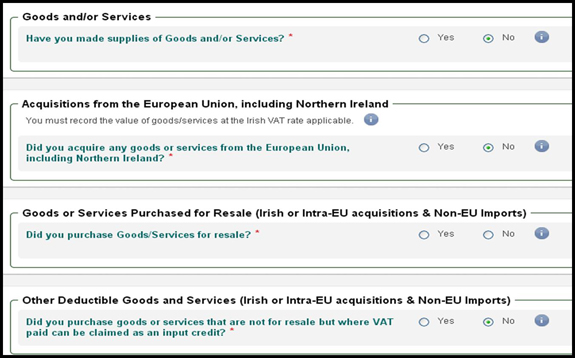

Step 5: If neither of the previous options is chosen, there are four categories of acquisitions and supplies available to complete in Screen 1 – provision of these details is now obligatory.

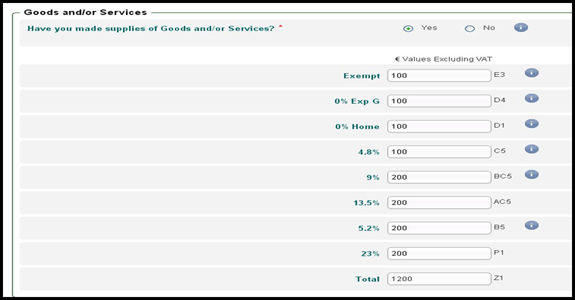

Step 6: Selecting "Yes" in any of the four categories in Screen 1 expands a range of fields and VAT Rates.

The expanded view for "Goods and Services" is shown above. Appropriate fields are also displayed in respect of all four categories in Screen 1.

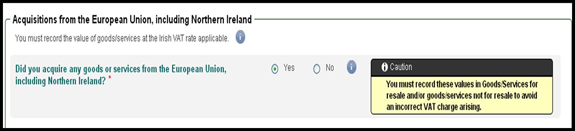

Step 7: Where the user indicates "Yes" in any of the categories in Screen 1, a short guidance note will appear for that category. For categories 2, 3, and 4, this note will only appear once any previous categories selected have been completed.

Step 8: At the bottom of the page, once all the applicable categories are completed the user has the option to print the completed form or continue.

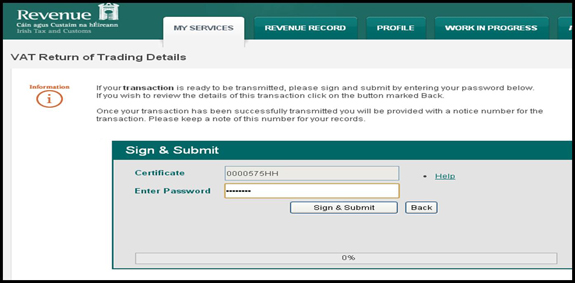

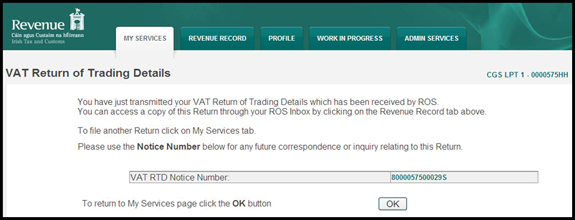

Step 9: Clicking "continue" brings the user to the "Sign and Submit" page. If the details are in order, please enter your password and select "Sign and Submit" which generates the Acknowledgement Screen below:

Step 10: By clicking "OK" in the Acknowledgement Screen, the User is brought to the "My Services" screen.

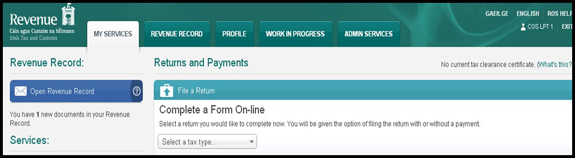

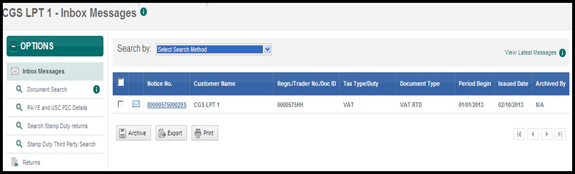

Step 11: Confirmation of Receipt is available by clicking on the "Open Revenue Record" tab, which will open the Inbox - VAT RTD details have been received.

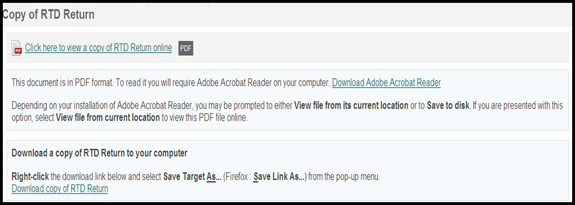

Step 12: By Clicking the "Notice No." link, VAT RTD viewing options are displayed. The completed VAT RTD will be presented in the existing format by selecting either option.

3. VAT RTD Filing Periods and Due Dates

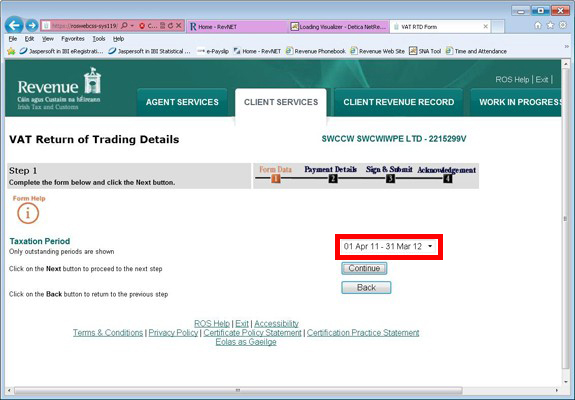

The VAT RTD Accounting Year is the 12-month period ending on the VAT accounting year end-date as indicated by the trader/agent on the VAT Registration form (or as subsequently amended by the trader/agent). In most cases, the VAT accounting year end-date coincides with the accounting year end-date for Corporation Tax purposes. However, this is not always the case. Note that the Taxation Period which will be shown in ROS Client Services when the RTD filing option is selected is based on the VAT accounting year end-date (highlighted in red below).

Figure 1. Client Services Screen for VAT RTD, showing appropriate VAT Accounting Year for Reg. No. 2215299V

The due date for the online submission of the VAT RTD to the Collector General is the 23rd of the month following the end of the VAT period in which the VAT accounting period end date falls e.g. if a VAT accounting year ends on the 30 June, the VAT RTD will accompany the May-June VAT 3 for that period and the VAT RTD must be submitted by the 23rd July.

3.1 Display of the VAT RTD Accounting Period in ROS

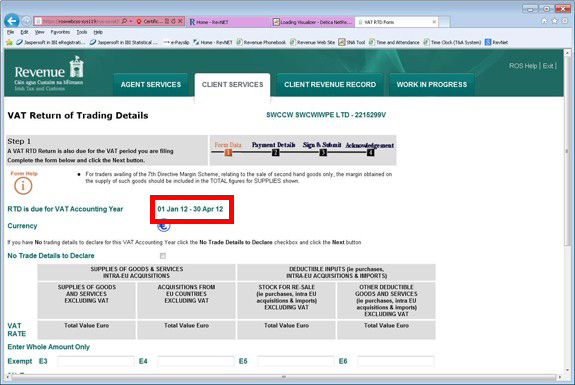

For a period following the release of the new RTD template, the Accounting Year displayed in the Return of Trader Details "Taxation Period" field of the Client Services screen (Figure 1) may not always match the period shown in the subsequent "RTD is due for VAT Accounting Year" field in ROS (Figure 2 overleaf). The latter field may show instead the bi-monthly or 4-monthly VAT 3 period in which the VAT accounting year ends (in the example below, a four-monthly VAT 3 period is highlighted in red).

Where this occurs, Agents are advised that the VAT RTD Taxation Period to be filed is the twelve-month period as shown in the Client Services Screen "Taxation Period" field (Figure 1 above).

Figure 2: Accounting Year shown on VAT RTD Screen, displaying VAT 3 period in which end-date of VAT accounting period falls rather than VAT Accounting Year.

4. Future VAT RTD Developments

In addition to the Revised VAT RTD format described above, it should be noted that additional measures to ensure compliance with Statutory VAT RTD filing obligations will be introduced in a number of stages in 2014-2015. These stages can be described briefly as follows:

Stage 2: Introduction of automated VAT RTD filing compliance measures including the withholding of VAT repayments in the absence of the most recent VAT RTD (projected mid-2014);

Stage 3: The introduction of a limited number of additional fields including the addition of new fields on the value of property disposals and acquisitions including those made as part of a Capital Goods Scheme adjustment (projected 2015).

Other changes not listed above may also be introduced as the project is developed. All developments will be notified to Agents in advance of implementation.