Happy New Year – the shape of UK tax in 2021

Introduction

As this unprecedented year of 2020 comes to an end, this article looks at the major items on the UK tax agenda for 2021 and beyond. At the time of writing, the end of the EU transition period also looms large. As discussions between the UK and the EU on a trade deal go down to the wire, a no-trade deal Brexit now looks like the only option left on the table.

Horizon scanning

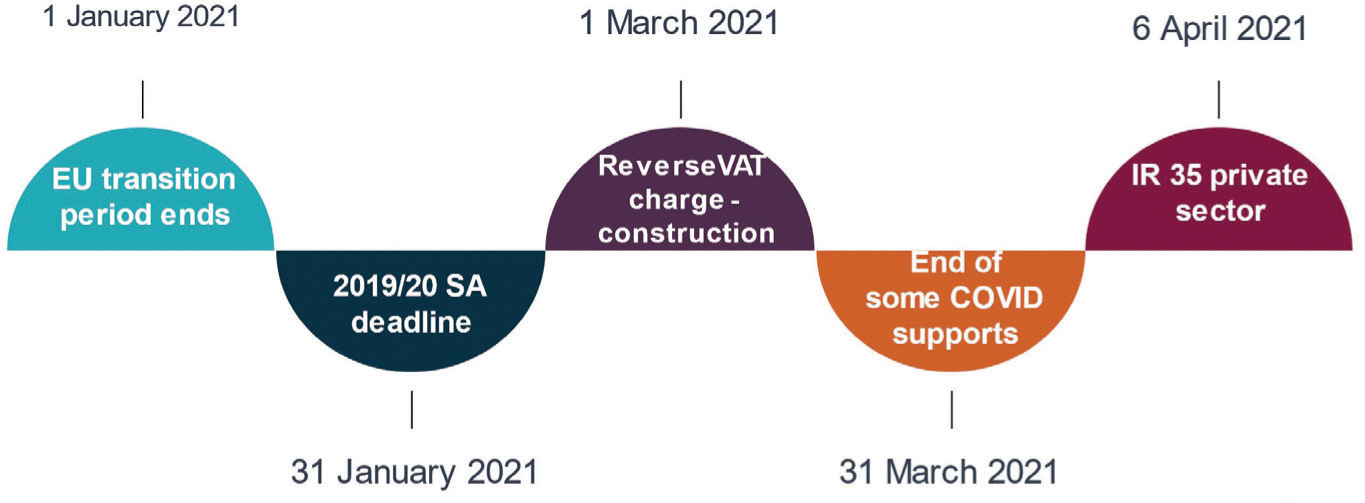

2021 will see another year of major change in the area of UK tax. The timeline of key changes coming up is as follows:

EU transition period ends

The UK left the EU on 31 January 2020 and entered into the EU transition period which ends at 11 pm on 31 December 2020. Our timeline of key changes, therefore kicks off with the end of the EU transition period. The Institute and its NI Tax Committee continue to engage with Government and HMRC on key matters such as customs procedures (including the Trader Support Service) and the complex VAT and customs rules which will apply in Northern Ireland from 1 January 2021. You can also read about key developments and guidance in this area in our bi-monthly Brexit digest.

As the UK moves closer to the end of the transition period, it is vital that businesses consider how the changing trading environment on 1 January 2021 will impact them and begin their preparations now.

The practical measures that businesses should now adopt, irrespective of whether or not a trade deal is agreed, include:

- Register online with HMRC for an EORI number – this will be needed for moving goods between Great Britain (England, Scotland and Wales) and the EU. You may also need one if you move goods to or from Northern Ireland. Check now if one is needed and apply as soon as possible;

- Contact your suppliers and logistics providers about the continuity of goods and services you need for trade;

- Check if your non-UK suppliers use the UK (particularly Northern Ireland) as a land-bridge and ascertain whether this will cost more and cause delays;

- Classify the goods that you import or export for customs duties and know their origin;

- Decide if you need to seek out a customs agent, sign up for the trader support service or have sufficient customs experience and knowledge to complete customs declarations in house;

- Ensure that you have a line of credit to deal with the customs duties that will arise on imports;

- Review the proposed dual VAT regime rules for Northern Ireland and consider how this will impact your business;

- Check whether your current certifications, licences or authorisations will be valid from 1 January 2021; and

- Consider using the various Government supports available including those for enhancing, in-house customs knowledge.

With the ongoing uncertainty surrounding the negotiations, one thing businesses can be sure of; come 1 January 2021, the trading environment will be vastly different.

2019/20 SA deadline

Next up is the 2019/20 self-assessment (“SA”) filing deadline. At the time of writing, HMRC is still asking taxpayers and agents to file 2019/20 SA returns by 31 January 2021 despite the impact of the pandemic. HMRC will consider COVID-19 as a reasonable excuse for missing some tax obligations (such as payments or filing dates), but you must explain how you were affected in your appeal and must still make the return or payment as soon as possible.

Many taxpayers deferred the payment of their second 2019/2020 payment on account which was due on 31 July 2020 until 31 January 2021. Any taxpayer unable to make their full payment of tax due by this date (which includes the deferred second payment on account, the balance due for 2019/20 and the first payment on account for 2020/21) may be able to set up a Time to Pay (“TTP”) payment plan of up to 12 months online without needing to contact HMRC.

Taxpayers with SA tax debts up to £30,000 and who need extra time to pay will be able to access the enhanced TTP facility and can get automatic and immediate approval. Those with SA debts over £30,000, or who need longer than 12 months to repay their debt in full, may still be able to set up a TTP arrangement but will need to contact HMRC to set it up.

The enhancement of TTP for 2019/20 SA debt was a lobbying recommendation of this Institute in its Next Financial Year position paper prior to being announced by the Chancellor in his September 2020 Winter Economy Plan.

HMRC are making it clear however that only taxpayers unable to pay their liability in full due to the pandemic are able to defer 2019/20 SA payments. This deferral process will require a Direct Debit to be set up by the taxpayer, and for this reason, agents will not be able to apply for deferral on behalf of their client.

This Institute continues to lobby HMRC for an automatic three month suspension of 2019/20 SA late filing penalties in light of the pandemic so that taxpayers are not required to incur unnecessary costs submitting an appeal against a penalty.

Reverse VAT charge – construction sector

From 1 March 2021, the construction sector domestic VAT reverse charge, already delayed twice from October 2019, is expected to come into operation. We do not expect HMRC to delay this further.

This new measure must be used for most supplies of building and construction services and applies to standard and reduced-rate VAT services:

- for individuals or businesses who are registered for VAT in the UK;

- reported within the Construction Industry Scheme.

If the VAT reverse charge does not apply, the normal VAT rules continue to apply.

Under the new rules, the customer (and not the supplier) within the construction industry receiving the supply of construction services will pay the relevant output VAT direct to HMRC rather than paying it to the supplier. The customer then reclaims the relevant amount on their VAT return via the reverse charge mechanism.

We recommend that businesses affected:

- make sure their accounting systems and software can deal with the reverse charge;

- consider whether the change will impact their cash flow and take mitigating action if necessary; and

- check that staff who are responsible for VAT accounting are familiar with the reverse charge and how it will work.

End of some COVID supports

Businesses who deferred VAT payable to HMRC from 20 March to 30 June 2020 due to the pandemic are required to pay this deferred liability in full to HMRC on or before 31 March 2021. However, such businesses have the option to further defer this by paying the amount due in smaller payments over a longer period instead of paying the full deferred amount by that date. If a business is able to pay the amount deferred by 31 March 2021, it is encouraged to do so.

The deferral takes the form of 11 smaller monthly interest-free payments which must be paid by the end of March 2022. Those who wish avail of the deferral option need to opt-in to the scheme which will require a direct debit to be set up as part of the digital opt-in process. Under banking regulations, this must be done by the authorised bank account holder. HMRC is therefore, once again, unable to provide an agent service for the scheme.

Readers should also note that the reduced rates of stamp duty land tax for residential properties, the 5 percent VAT rate for the hospitality sector and the job retention and self-employed income support schemes are also scheduled to end on 31 March 2021. Budget 2021, which is not expected to take place until mid-March, will either confirm these cliff edges or potentially introduce new supports in their stead.

IR 35 private sector rules

Delayed from 1 April 2020, the off-payroll working rules or “IR35” are extended to the private sector from 6 April 2021. This means that from this date medium or large-sized private sector clients will be responsible for deciding the employment status of contractors which means paying tax and NIC as if they were an employee instead of a contractor where the IR35 rules apply.

Broadly, an exemption from these rules is only available if the private sector business meets two or more of the following conditions:

- annual turnover of less than £10.2 million;

- balance sheet total (gross assets) less than £5.1 million; and

- less than 50 employees

Whilst there’s lots of guidance available on GOV.UK to help businesses prepare for the change, the scale and impact of this change across a business should not be underestimated. Businesses should begin the process of assessing the impact of this change by examining the different contractual relationships they hold, including those directly with Personal Service Companies, or, with agencies or other service providers in the context of the rules.

Suggested actions in advance of the changes include:-

- Reviewing and identifying contractors currently working within your business;

- Assessing if they are inside or outside the new rules – you can use the Government’s Check Employment Status for Tax service to help you determine whether IR35 applies;

- Opening dialogue with your contractors;

- Reviewing your agreement/contractor engagement policy;

- Considering if your costs will be higher as a result of the application of these rules; and

- Assessing the impact on your HR and payroll systems, including any software changes which may be needed.

The future

And finally, it would be remiss of me not to examine two long-running HMRC projects, Making Tax Digital (“MTD”) and the consultation examining options to raise standards in the UK tax advisers market.

Making Tax Digital

It’s true that the pandemic has broken several business ‘taboos’ and accelerated the role of digitisation in all walks of life. The UK tax system is no different. On the back of these lessons, in July 2020, the UK Government published its vision for tax administration in the UK “Building a trusted, modern tax administration system.”

An important part of the July publication was the announcement of further steppingstones in the roadmap of the MTD project starting with extending MTD for VAT to VAT-registered businesses with turnover below the current £85,000 VAT registration threshold from April 2022. MTD for income tax will commence for self-employed businesses and landlords with income over £10,000 from April 2023.

HMRC is also currently consulting on MTD for Corporation Tax. This consultation is open for 16 weeks and will close on 5 March 2021, however the earliest start date for mandation will be April 2026.

Tax advisers consultation project

The NI Tax Committee responded to this consultation in August. This consultation is one of the most important consultations for many years. As part of this, HMRC is exploring potential options to regulate the UK tax profession ranging from more effective use of their existing powers to consumer protection options and external regulation of agents, including those who are members of a Professional Body.

The key message of the Committee in its response was that there should be no further regulation of qualified agents who are members of Professional Bodies with a strong, effective, and active regulatory function, such as members of Chartered Accountants Ireland and that HMRC’s focus should be on using its existing powers more effectively in combination with compulsory Professional Indemnity Insurance (“PII”) for tax advisers and other consumer protection measures.

Last month the Government’s response to the tax advisers consultation was published. The direction of the consultation response is in agreement with the NI Tax Committee’s recommendation of compulsory PII and there are currently no plans for external regulation of already regulated advisers such as members of this Institute which was also a key recommendation of the Committee.

Next steps in this project were published alongside the summary of responses, which includes plans for a consultation on the requirement for all tax advisers to possess appropriate levels of PII insurance. The consultation will also seek feedback on the definition of tax advice. The NI Tax Committee of this Institute will continue to engage with HMRC as both these projects continue.

Final note

And finally, it would be remiss of me not to reflect on the year that was 2020.

“Harry Truman, Doris Day, Red China, Johnnie Ray, South Pacific, Walter Winchell, Joe DiMaggio….” sang Billy Joel in his famous 1989 song We Didn’t Start the Fire. If Billy were to rewrite that song for 2020, in the year that this has been, he’d be writing about social distancing, lockdowns and face masks to name but a few standout items in what has truly been an unprecedented year that has touched households, lives and businesses worldwide.

My heartfelt thanks go out to those essential workers on the front line who have cared for the ill and kept our country going, both North, South and further afield. I think it is important to recognise the role Chartered Accountants have also played, in keeping businesses going by burning the midnight oil with advice and work on the various COVID schemes, grants and supports. It’s times like this that I can safely say I am proud to be a Chartered Accountant.

There’s no doubt that 2021 will also prove to be a challenging year for the UK tax profession. But 2020 has shown us that we’re up to that challenge and then some.

Leontia Doran, UK Tax Specialist for Chartered Accountants Ireland