DLA Piper’s Éanna Mellett and Matthew Cole explain what a management team should know when contemplating a private equity-backed management buy-out.

Private equity (PE) has dramatically altered the management buy-out (MBO) market. The days of the traditional debt-backed MBO are long gone. If MBOs happen these days, they are almost exclusively backed by PE.

So, if you are part of a management team contemplating a PE-backed MBO, what should you know and what should you be worried about?

Everyone wants to know: “what is market?” This can be in the context of M&A terms, equity terms (or indeed, just about anything else), if only to establish a baseline against which to gauge your own performance.

What a management team needs, though, is a view of “market” that is based on more than what a lawyer can remember from their last few deals or a general hunch.

DLA Piper has the most comprehensive global database of M&A and MBO deals. And as the only law firm with a specialist management advisory practice operating in Ireland, it is uniquely positioned to provide benchmarking data and intelligence to answer those all-important “what is market” questions.

DLA Piper produces a Global Private Equity Terms Report, which collates and analyses management terms, data and trends from hundreds of global PE deals. It delivers a reliable and comprehensive view of “market” from one of Europe’s largest PE law firms. The report captures the knowledge DLA Piper has gained from consistently acting on more buy-outs in Europe than any other law firm and being Europe’s leading management advisory practice.

What size of equity pot should be available to management?

Standard pot size is one of the most frequently asked questions and one of the most obvious comparable data points. However, in practice, its real value depends on a variety of other factors, which include:

- The coupon of the loan note/preference shares that it sits behind;

- Whether it is genuinely ring-fenced for the management team;

- Whether there is a ratchet;

- Whether there is non-dilutive bolt-on financing; and

- The management team’s appetite for risk.

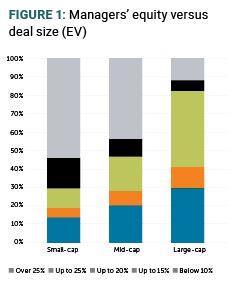

Predictably, the pot size decreases as the deal’s enterprise value increases, as shown in Figure 1.

What is more surprising is the difference in treatment around the ring-fencing of the pot (meaning that the sweet equity is only used for incentivising management and is fully issued). Without ring-fencing, the headline pot size may be little more than a theoretical possibility. The larger the deal size, the more likely the pot will be truly ring-fenced. 16% of small-cap deals (deals with a value of up to €50 million) have ring-fencing while the percentage increases to 45% of mid-cap (€50-250 million) and large-cap deals (€250 million-plus).

Even more striking is the correlation between ring-fencing and the involvement of specialist advisors with management teams. For example, in deals with specialist financial advisors or when DLA Piper is acting for management teams, ring-fencing appears in 60% of deals.

Ratchets

Ratchets are a subject that divides. Some PE houses simply will not entertain them as a matter of policy. Others see the downsides of additional complications and potential misalignment of interest as a price worth paying to bridge the gap of equity expectations.

Only a minority of deals have ratchets, although their use has become more common over the last three years. They appear more frequently in technology deals and are less likely in the sub-€250 million market, where 25% of deals have ratchets compared to 44% of €250 million-plus deals. Where ratchets are used, the majority have a money multiple and an internal rate of return (IRR) threshold.

Rollover

Rollover is usually a headline issue and often a contentious one. There is a difference in approach between PE houses and advisors based on geographic location, which hints at divergent local market norms.

Most practitioners will say “market” is about 50%, but this masks a more complicated picture. For instance, the size of the deal matters. The smaller the deal size, the lower the proportion of proceeds managers are required to roll over.

Leavers: the good, the bad and the rest

You will hear about good leavers, intermediate leavers, bad leavers, no-fault leavers, very bad leavers and early leavers. The list goes on, and the same phrase can mean different things to different people.

So here, we have simplified it because the questions are, at one level, quite simple:

- What does a manager have to sell?

- At what price?

The answer to the second question depends largely on the circumstances of a manager’s departure, the most common being:

- Death or permanent disability;

- Dismissal;

- Resignation; or

- Summary dismissal for cause.

There is significant divergence that splits on geography and deal size for the most common type of leaver – a manager who is asked to leave because their role is obsolete or the PE house no longer thinks that the person in question is performing.

In a classic London-led £250 million-plus deal, sweet equity will value vest with debate taking place over whether it vests annually, quarterly or monthly. Elsewhere, with US-based PE houses and on smaller deals, there is more debate around whether there is any value vesting at all.

Attacking “the strip”

Where managers roll over into the institutional strip on a non-primary deal, the most common position used to be that the strip was “earned money” and therefore sacrosanct – although this was less common outside the London market.

That position has become more blurred, with an attack of some sort possible if the manager competes or has been dismissed on grounds justifying summary dismissal.

About DLA Piper Ireland

If you are undertaking a PE deal, you need to be advised by people who know the answer to “what is market?” and have experience of the differing approaches taken by the various PE houses.

DLA Piper acted on more European PE buy-outs and exits than any other law firm in 2020 and is the only law firm operating in Ireland with a specialist management advisory practice. Personalised copies of DLA Piper’s M&A Intelligence and Equity Terms Reports are available from the authors or the DLA Piper website, www.dlapiper.com/IECorporate.

DLA Piper has been named by Mergermarket as the world’s number one law firm for M&A (by volume) for each of the last 11 years.

Éanna Mellett is Partner and Head of Corporate at DLA Piper in Dublin. Éanna can be contacted at eanna.mellett@dlapiper.com.

Matthew Cole is Corporate Partner at DLA Piper in Dublin. Matthew can be contacted at matthew.cole@dlapiper.com.

LOADING...

LOADING...