The launch of a consultation on a new national financial literacy strategy for Ireland is welcome and accountants will be key as gatekeepers of financial knowledge, writes John Nolan

Making financial decisions and navigating the world of finance is an unavoidable part of life, from setting up your first savings account to planning for your retirement and everything in between.

However, increasing numbers of people in society struggle with such tasks and these difficulties are further exacerbated by the ongoing digitisation of financial services.

‘Financial literacy’ is the ability to engage with the financial system and to effectively manage your finances. While the concept is hardly new, it has received notable academic and political attention in the years since the onset of the global financial crisis in 2008.

That period was an inflection point that highlighted the financial struggles of many households and small businesses and the implications for the broader economy and society. o

Since then, the financial experiences of many during the recent COVID-19 pandemic and the current period of high inflation and interest rates have heightened the focus on this issue at a government policy level.

Low levels of financial literacy

Research by the Organisation for Economic Co-operation and Development (OECD) has shown that financial literacy levels are worryingly low across the world.

In the EU, a 2023 survey found that just 18 percent of respondents have high levels of financial literacy, with Ireland only marginally better at 19 percent.

These findings are a big concern for public policymakers because financial literacy improves our financial resilience and ability to deal with financial shocks, it increases our financial wellbeing and it contributes to the stability of the financial sector overall.

European Commissioner Mairead McGuinness is leading a policy initiative focused on financial literacy and encouraging European Union (EU) member states to develop national strategies aimed at ensuring a coordinated approach to financial education.

This comes on the back of over a decade of work by the OECD International Network on Financial Education (OECD/INFE) in establishing best practice guides for the development of national strategies and the measurement of financial literacy within populations.

A national financial literacy strategy

In Ireland, Minister Michael McGrath recently announced plans by the Department of Finance to develop a national financial literacy strategy.

This is a welcome move and one that a variety of stakeholders have been calling for, including the Central Bank of Ireland, Social Justice Ireland and the Competition and Consumer Protection Commission (CCPC).

The new strategy will help to ensure Ireland is compliant with the G20/OECD High-Level Principles on Financial Consumer Protection and the OECD Recommendation on Financial Literacy.

We have been behind the curve in this area, with the Retail Banking Review published in 2022 by the Department of Finance noting that Ireland is one of just four EU member states that does not have a national strategy for financial literacy.

While some important studies and reports have been undertaken in an Irish context – by the National Adult Literacy Agency (NALA) and by the CCPC, for example – there is no coordinated national approach to financial literacy.

There remains a need for an overall framework for financial education initiatives, funding for research to develop baseline measures for financial literacy across the population and to support evidenced-based interventions, and a clear set of objectives to guide stakeholders.

The decision to engage with stakeholders to develop a national strategy is perhaps the easiest step to take. The devil will be very much in the detail as we progress to the substance of what such a strategy might entail and where the focus and investment should go.

Three issues illustrate this complexity – and this is by no means an exhaustive list:

Where to start?

First, one critical decision is which groups in society should be targeted initially to ensure the most effective use of resources and that true value is derived from financial education initiatives.

The G20/INFE High-Level Principles suggest that focusing on specific (or vulnerable) groups for financial literacy interventions makes sense for many countries.

Research by both the OECD and EU has shown that there are some cohorts within populations that tend to have consistently lower financial literacy levels.

The recent launch by Commissioner McGuinness of a joint EU/OECD-INFE financial competence framework for children and young people highlights one relevant group that might be a natural starting point for any national strategy.

A focus on young people’s financial literacy – and embedding this in education systems to facilitate a culture of financial conversation early in life – seems logical.

Research has identified numerous other groups with consistently lower levels of financial literacy, including the elderly, low-income households, migrants and those with low digital literacy, for whom financial literacy interventions would be particularly beneficial.

One additional group is of particular relevance to accountants and it is under-researched in the context of financial literacy – entrepreneurs and small business owners.

The transition from the personal to the entrepreneurial in the context of financial literacy is significant.

The additional scale, responsibilities and complexity of the financial landscape for small businesses can overwhelm their owners.

The absence of financial literacy in the indigenous business sector has the potential to be just as damaging to the economy as a lack of personal finance skills among the general population.

Financial literacy as a social practice

Financial literacy is a social, rather than just a technical, practice. It is a social and human-centred practice in the sense that it is heavily influenced by peers, family and social institutions.

It is a much more complex issue than a mere ‘skill gap’ to be solved through financial education interventions.

Taboos surrounding personal finances, and discussion on the topic, can have a significant impact on how people view its importance and the need to upskill in the first place.

An appreciation of the complexity of financial literacy and how it fits within the social and cultural fabric of communities will be a serious consideration for any new national strategy.

Clear concepts and terminology

Discussing financial literacy and developing a strategy is further complicated by how its key concepts and terms have changed over the past two decades.

For example, the UK’s national strategies have evolved from a Financial Capability Strategy for the UK in 2015, which was replaced by the UK Strategy for Financial Wellbeing in 2020.

While traditionally associated solely with knowledge, ‘financial literacy’ has evolved to encapsulate skills, behaviours and attitudes, which is closely aligned to the concept of ‘financial capability’. The terms are now often used interchangeably.

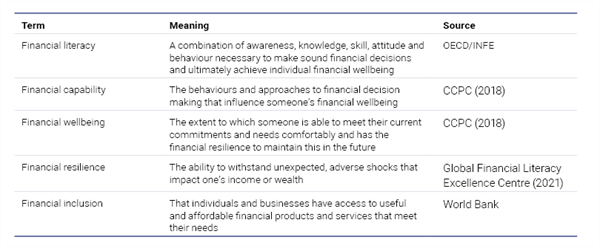

The table below presents some of the key terms currently used in this area, and how they have been defined.

The overarching goal of achieving ‘financial wellbeing’ is itself difficult to define and will mean different things to different people.

Thus, in the context of any new national strategy, it will be important to clearly articulate the objectives and what is meant by the terminology that is used. Finance is a sector whose jargon can overwhelm people, so it will be essential that any new strategy avoids this.

Public interest

The evolving policy focus on financial literacy should be of interest to accountants. A commitment to the public interest is one of the hallmarks of the profession.

Given the emerging evidence of the impact that poor financial literacy has on wealth inequality, financial exclusion and other adverse financial outcomes, addressing this issue is clearly in the public interest.

Accountants occupy a crucial position in society as gatekeepers of financial knowledge. We have a responsibility to utilise this position for good, both at an individual level in our interactions with clients, colleagues and the community and at a collective level in terms of support for the new national financial literacy strategy.

This is not just a policy for individuals and households; it is also for entrepreneurs and micro, small and medium-sized enterprises. Accountants, as trusted business advisors with financial expertise, have a key role to play in shaping and applying this policy.

Financial literacy is about our relationship with money, which is, whether people like it or not, a core part of society. Promoting a culture of positive engagement with the financial sector and discussing finance from an early age is vital for a functioning economy and society.

Individuals and businesses rely heavily on financial services every day; at a minimum they should be confident and capable of accessing and engaging with what they need.

While financial literacy is likely something most accountants take for granted, for many in society it is a significant challenge. This is something we will be hearing a lot more about from a policy perspective in the coming months and years.

Dr John Nolan, ACA, is a lecturer in corporate finance and financial reporting at the University of Galway

LOADING...

LOADING...