Following the release of two new standards by the International Sustainability Standards Board, Linda McWeeney outlines what companies can do now to prepare for their application

The International Sustainability Standards Board (ISSB) has released two sustainability standards.

It will be for jurisdictional authorities to decide whether to mandate use of the International Financial Reporting Standards (IFRS) Sustainability Disclosure Standards, consistent with the approach taken for IFRS Accounting Standards issued by the IASB.

These will be effective for annual reporting periods on or after 1 January 2024.

The main aim of the new ISSB sustainability standards (S1 and S2) is that, initially, companies will provide reasonable and supportive information with regard to sustainability. The ISSB has provided reliefs and guidance.

Year one requirements

Even though there will be a requirement to provide sustainability reporting information along with the financial statements, companies can hold off on this reporting in year one and align it with their half yearly reporting where necessary.

There will also be no requirement for comparative information in year one. Companies using different methods can continue to use these methods for measuring scopes for the first year and will continue to align methods with the Greenhouse Gas (GHG) Protocol.

S1 and S2 will not be entirely new to many companies as they have been developed and built on the Task Force on Climate-related Financial Disclosures (TCFD) framework and Sustainability Accounting Standards Board (SASB) standards.

Investors and regulators demand and need high-quality, comparable information about risks and opportunities in relation to climate change in particular.

TCFD disclosure recommendations

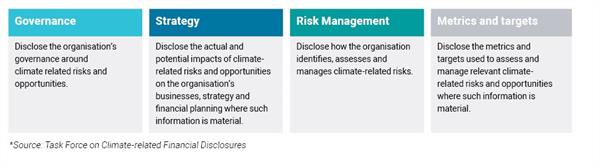

The TCFD sets out disclosure recommendations based upon core elements around which companies operate. These are:

- Governance

- Strategy

- Risk management

- Metrics and targets

The disclosure recommendations are structured around these four elements. This information should help investors understand how the relevant reporting organisations think about and assess climate-related risks and opportunities:

Governance

Companies need to describe the board’s oversight of climate-related risks and opportunities.

Processes need to be in place to identify climate-related issues and boards need to be kept informed regularly on these issues. Climate needs to be part of the company’s strategy, policies, plans, budgets, goals and targets.

Strategy

Companies need to be able to describe the climate-related risks and opportunities and their impact on the organisation’s businesses, strategy, and financial planning.

Risk management

Processes need to be in place for identifying and assessing climate-related risks. How significant climate-related risks are in relation to other risks should be discussed and analysed. Boards should consider regulatory requirements related to climate change and how to mitigate and control material risks.

Metrics and targets

Metrics used by the organisation to assess climate-related risks and opportunities in line with its strategy and risk management process should be disclosed. GHG emissions should be calculated in line with the GHG Protocol methodology to allow for aggregation and comparability across organisations and jurisdictions.

Reporting on emissions

Companies are required to report on emissions. Direct emissions are generated from sources owned and controlled by the reporting company – e.g., transport fuels, heating fuels and fugitive gases or emissions of GHG associated with particular manufacturing processes. These emissions are classified as scope 1.

Indirect emissions are also generated as a consequence of the activities of the reporting company—but occur at sources owned or controlled by another company. These include scope 2 and scope 3 emissions.

Scope 2 includes the emissions associated with the purchase of electricity, heat, steam and cooling. Companies can identify these energy uses on the basis of utility bills or metered energy consumption at facilities within the inventory boundary.

The ISSB has agreed that a company disclosing scope 2 emissions would use the locations-based approach, which emphasises the connection between consumer demand for electricity and the emissions resulting from local electricity production.

Within a particular geographic boundary and over a specified time period, electricity output is aggregated and averaged.

Scope 3 emissions include entire value chain emissions. The majority of total corporate emissions fall under this scope from the goods it purchases to the disposal of the products it sells.

While Scope 1 and 2 emissions are within the control of the company as they are operational, scope 3 emissions raise business development and strategy questions pertaining to products and services.

Companies using different methods can continue to use these methods for measuring scopes for the first year and will continue to align methods with the GHG Protocol.

Companies can also continue to be guided by the Global Reporting Initiative (GRI) and European Sustainability Reporting Standards (ESRS) to help assess and take responsibility for their impacts and contribute to a more sustainable future using a multi-stakeholder and investor-focused approach.

Next steps

The standards will be effective for annual reporting periods on or after 1 January 2024 and individual jurisdictions will decide whether and when to adopt the IFRS Sustainability Disclosure Standards.

The ISSB has stated that it is working closely with jurisdictional standard setters to maximise interoperability between its standards and incoming mandatory reporting frameworks including the European Commission with their European Sustainability Reporting Standards (ESRS), and the US Securities and Exchange Commission.

Linda McWeeney is Non-Executive Director and Senior Lecturer in Accounting and Finance at Technological University Dublin

LOADING...

LOADING...