The Department for the Economy unveiled an ambitious plan to boost the Northern Ireland economy in 2021, but will it be up to scratch? Professor Anne Marie Ward, Dr Esmond Birnie and Dr Stuart Henderson crunch the numbers to find out if the 10x Economy vision can deliver.

Some argue that the Northern Ireland (NI) economy has strong potential given its apparent unique trade position as a halfway house between Europe and Britain, combined with the Department for the Economy’s (DfE) ‘10x Economy’ policy, which targets innovation, inclusion and sustainability.

Yet, despite experiencing 25 years of peace, NI continues to suffer from political uncertainty and lower economic productivity relative to Britain and the Republic of Ireland (ROI). Moreover, ongoing uncertainties associated with Brexit continue to dampen potential foreign direct investment, which has been vital to the strong economy in ROI.

It is against this backdrop that the DfE introduced a new growth policy in May 2021 aimed at achieving a 10-times better economy (‘10x economy’) by 2030.

The 10x vision is underpinned by objectives grouped into three pillars—innovation,

inclusive growth and sustainability—and focuses on six priority sectors:

1. Agricultural technology (agritech);

2. Life and health sciences;

3. Advanced manufacturing and engineering;

4. Financial services and financial technology (fintech);

5. Software (including cybersecurity); and

6. Screen and low carbon.

The data

The Northern Ireland Economic Trade Statistics (NIETS) is a new dataset that provides details on trade between NI and Britain for the first time. We have analysed this dataset, which covers the period 2014–2020 and comprises a sample of enterprises that are VAT or PAYE registered and trade in NI.

Approximately 5,000 to 7,000 enterprises respond to the survey annually. As part of our research, we examined the 10x priority sectors over the period 2014–2020.

Data on financial services and fintech are not included in the dataset and due to GDPR issues, we had to merge some of the 10x priority areas, ending up with four 10x sectors:

• Agritech;

• Health and life sciences;

• Advanced manufacturing (including low carbon); and

• Software and screen.

Approximately 11.4 percent of the total sample is classified as being 10x. Here is a summary of our findings.

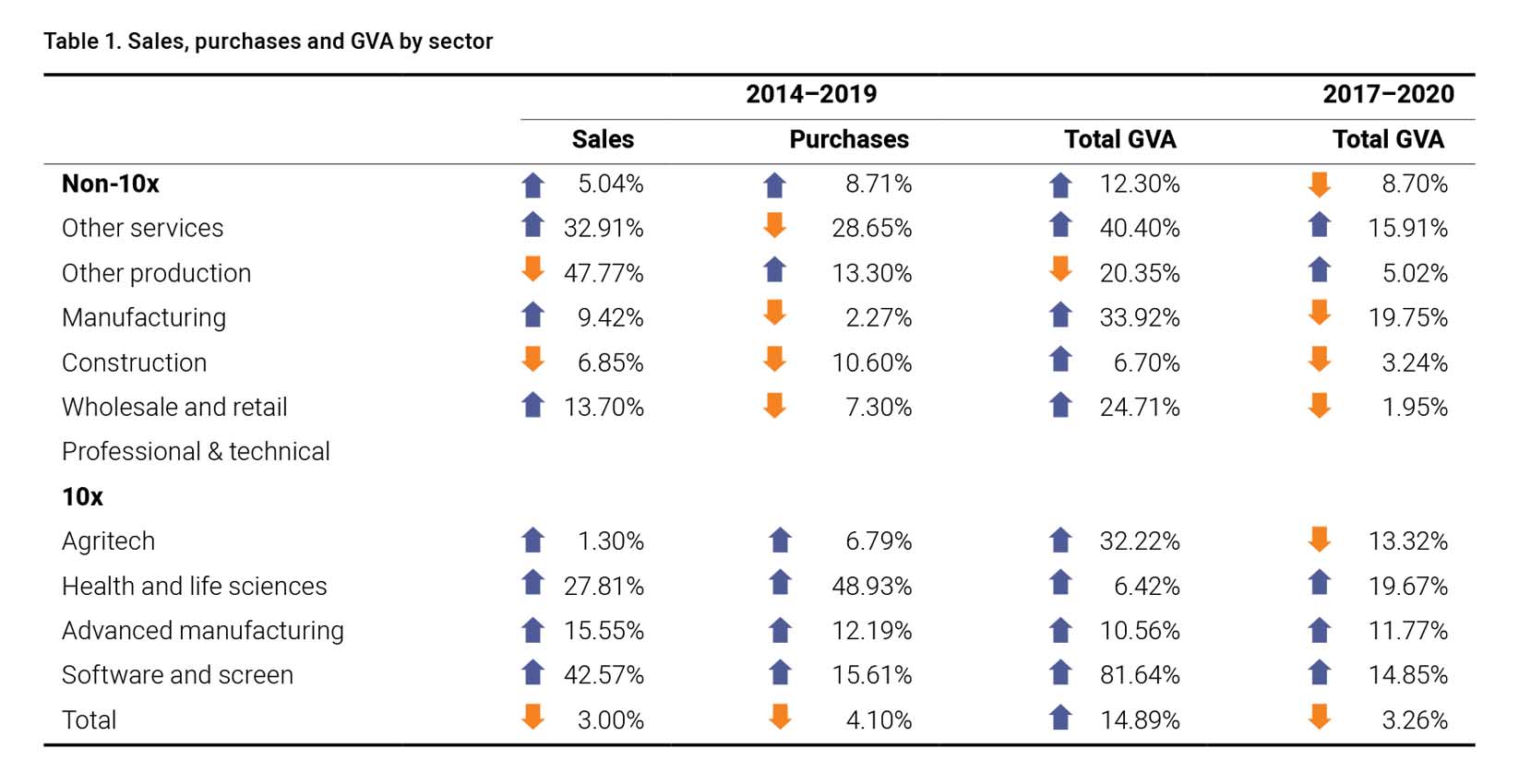

Growth in sales and gross value added (GVA)

As shown in Table 1, the 10x sectors of the NI economy were relatively resilient from 2014–2020 as total Gross Value Added (GVA) increased over the period, though agritech was negatively impacted by COVID-19.

Performance of the non-10x sectors improved over the period 2014–2019, as evidenced by increased total GVA (except traditional manufacturing, which declined by 20.35%). Most non-10x sectors were adversely impacted by COVID-19, however, except manufacturing and ‘other’ production.

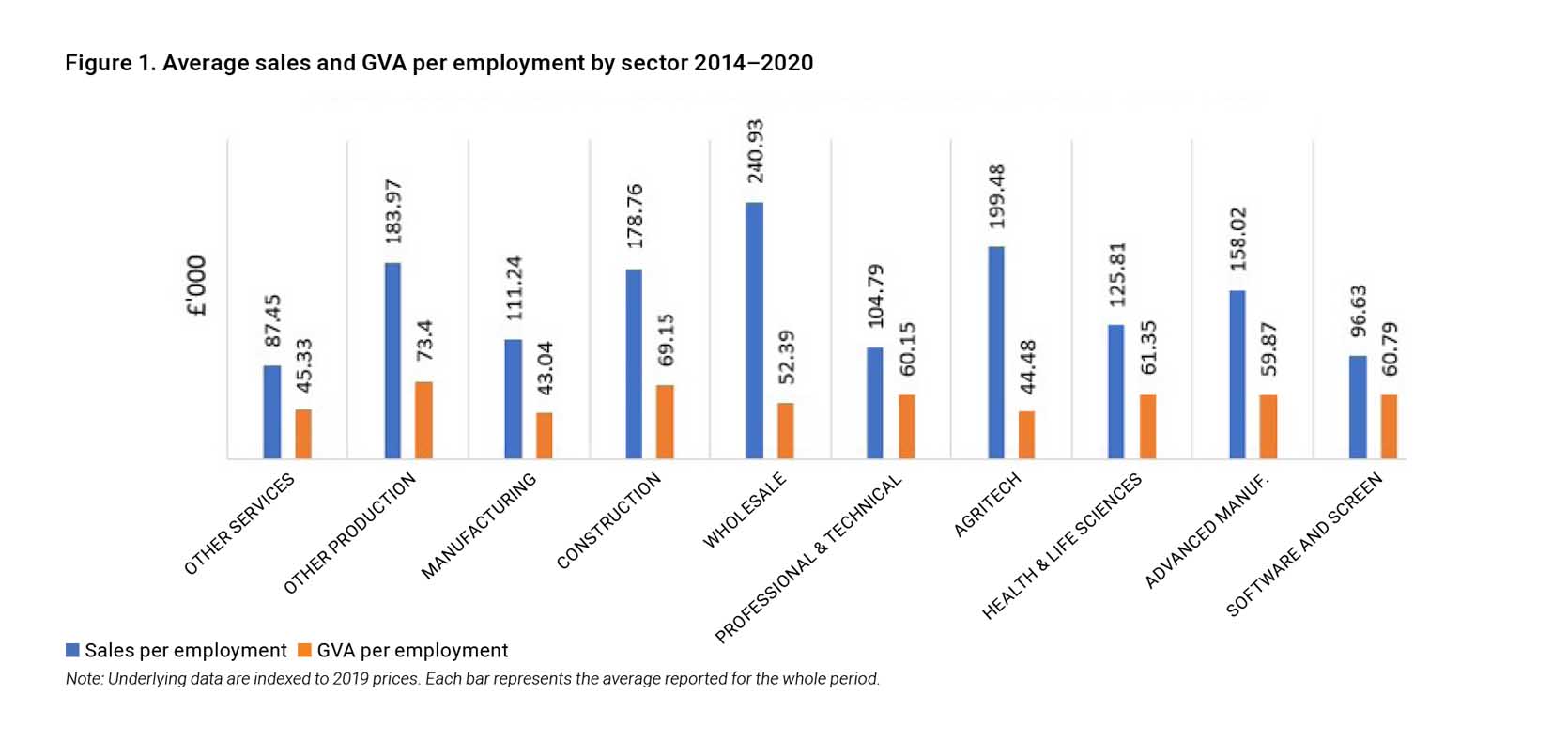

Productivity

Productivity is measured by the ratio sales per employment and GVA per employment. As illustrated in Figure 1, for 2014–2020, the wholesale and retail sector had the highest sales per employment, followed by agritech and other production. Other production has the highest GVA per employment, followed by construction, health and life sciences and software and screen. Agritech has the second lowest GVA per employment.

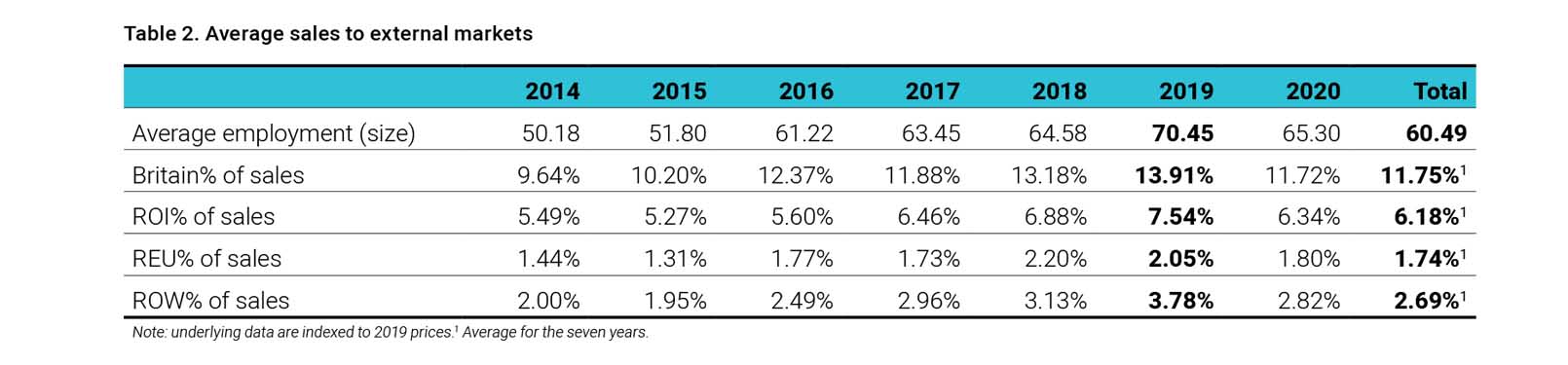

External sales behaviour

A country’s wealth is influenced by its ability to attract funds from external markets. To determine how NI is doing, we investigated the trade behaviour of NI enterprises using four ratios, which reflect the percentage of overall sales each business undertakes with Britain, ROI, the rest of the European Union (REU) and the rest of the World (ROW). The average percentage for each year (2014–2020) for the whole sample is provided in Table 2.

The most important external market is Britain, accounting for on average 11.75 percent of sales, followed by ROI (6.18%), ROW (2.69%) and REU (1.74%). Generally, the percentage of total sales to these external markets increased steadily over the period 2014–2019 and declined in 2020, coinciding with COVID-19.

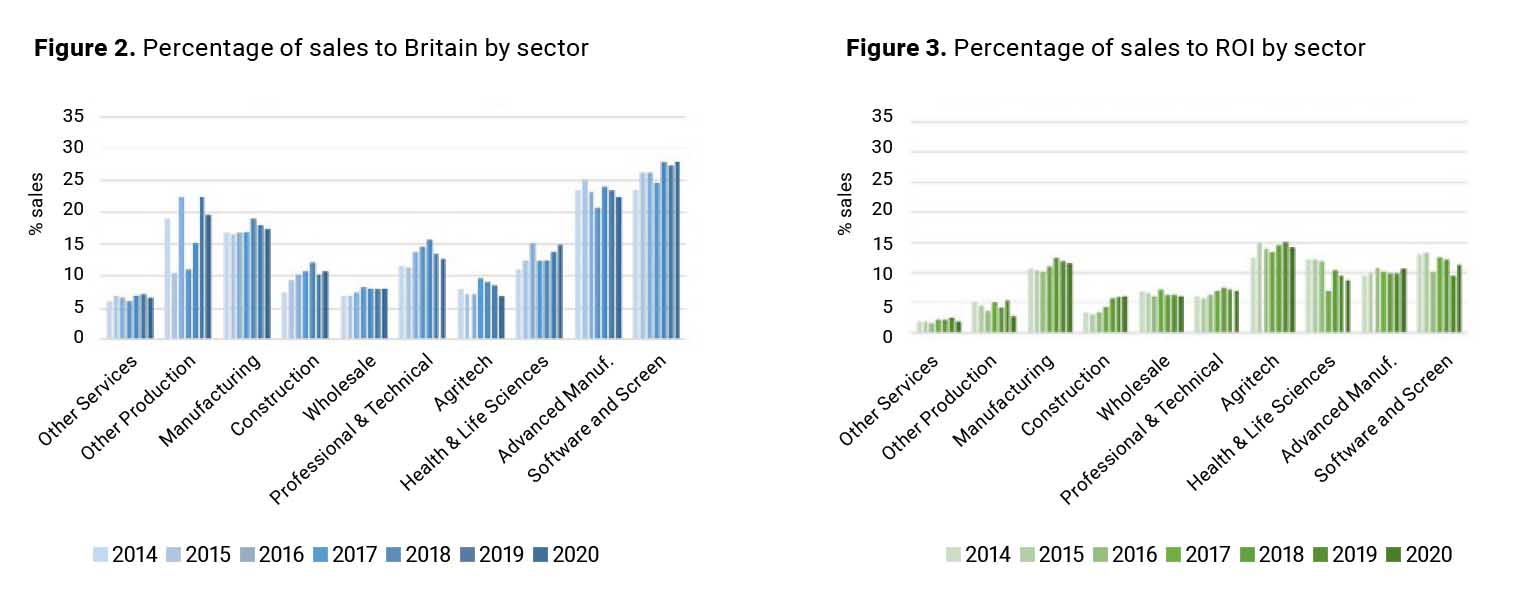

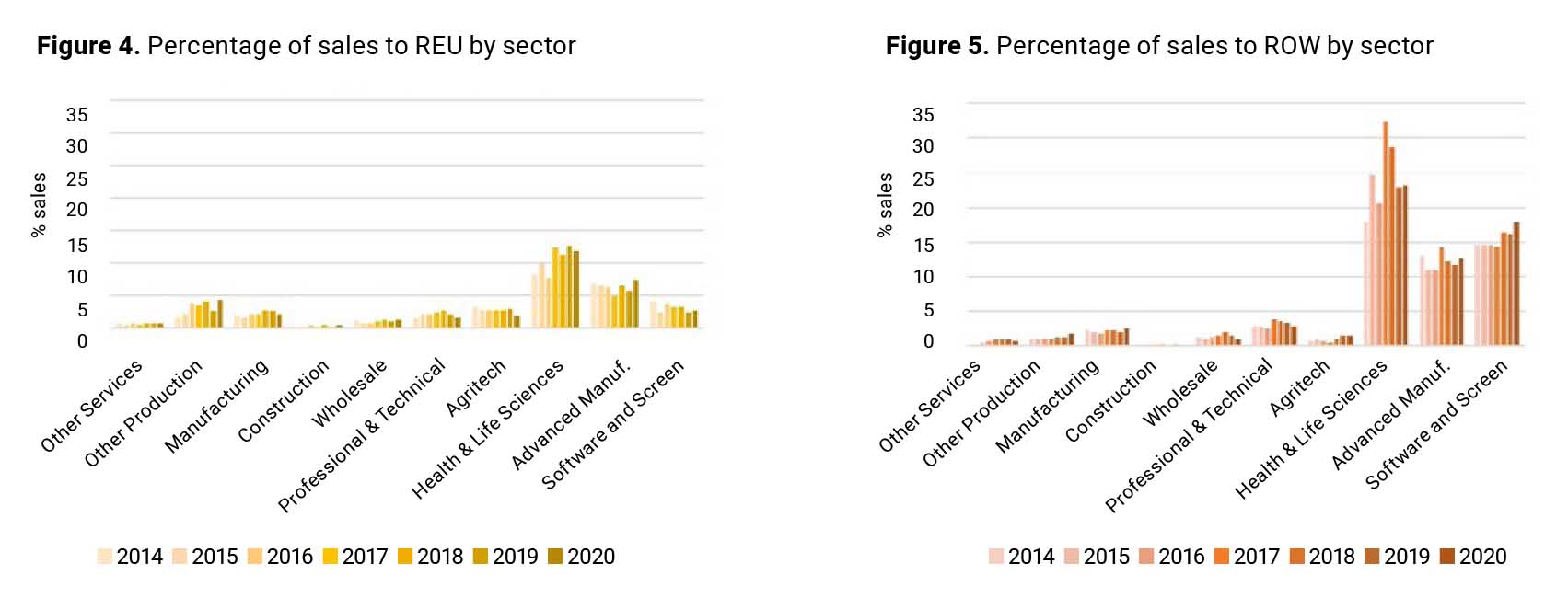

Patterns in the percentage of total sales to the four markets are further analysed by sector over the period 2014–2020 in Figures 2 to 5. Sectoral differences are evident. Generally, non-10x enterprises (the six to the left-hand side of each figure) are less engaged with external markets relative to 10x enterprises (the four to the right-hand side of each figure).

Differences in the relative importance of markets is also observed across sectors. For example, the ROI market is most important to the agritech sector (Figure 3), and the ROW market is most important to the health and life sciences sector (Figure 5), probably indicative of sales to the US. This sector is also very active in markets in the REU (Figure 4).

Note: When interpreting these results, be aware that the data is based on the largest enterprises in NI and the authors had to design their own 10x categories based on Standard Industrial Classification codes.

Will it work?

The number of enterprises in NI that can be classed as ‘10x’ increased over the period from 619 in 2014 to 723 in 2020. They are contributing GVA to the economy and, importantly, most of their turnover is to external markets, which is beneficial for a small regional economy where local demand is limited.

These enterprises seem to be resilient, with little change in behaviour observed in the period after Brexit, and, with the exception of agritech, they continued to grow despite COVID-19 (though the data was only available for 2020).

In theory, the DfE’s ambitions are laudable. Cluster approaches have proven successful in other countries, including ROI, where foreign-owned high-tech enterprises pay higher wages, invest in R&D for future growth and have high exports.

Moreover, the vision of sustainable growth and prosperity for all (levelling up) aligns with more holistic concepts of economic growth that account for social and environmental concerns alongside economic prosperity.

There are concerns, however. This is an ambitious undertaking that will take time to implement. The 2030 target set by the DfE is tight, the support structures to fuel 10x growth are not yet fully established, ‘10x’ is not yet fully defined, ‘place’ is not yet fully defined and hence the data are not (yet) available to enable 10x to be identified and analysed by place.

This will hinder the ability to foster clusters and build networks, which are important for innovation. Also, change will be difficult due to existing established structures.

For example, most policy and government action is managed through Local Government Department (LGD) level structures. However, clusters of enterprises may cross LGD boundaries, complicating a joined-up approach.

In addition, economic and social development is not only managed by the DfE; many other bodies such as central government and local government departments, business networks and educational establishments, are involved.

Role for accountants

Accountants can play an important role in the success of the DfE’s policy and the future of the NI economy. Accountancy firms are present in most towns across the region. Accountants are part of local business networks and have first-hand knowledge of entrepreneurship and innovation within communities.

Moreover, accountants are well-equipped to facilitate the creation of priority clusters and expanding networks that enable local businesses to connect and grow both within and beyond their communities. This will be good for communities and for the accountancy profession.

*Note: The tables and diagrams in this article are from the authors’ full report,

available on the Northern Ireland Statistics and Research Agency website.

Professor Anne Marie Ward, FCA, is Professor of Accounting at Ulster University; Dr Esmond Birnie is Senior Economist at Ulster University; and Dr Stuart Henderson is a Lecturer in Financial Services at Ulster University.

LOADING...

LOADING...