A new report proposes measures for the sustainability of owners’ management companies and lays the foundation for a more structured approach to managing apartment complexes or managed estates.

By David Rouse

In a professional audit or reporting capacity, Chartered Accountants may encounter owners’ management companies (OMC). Readers living in an apartment complex or managed estate may even have been asked to serve as an OMC director.

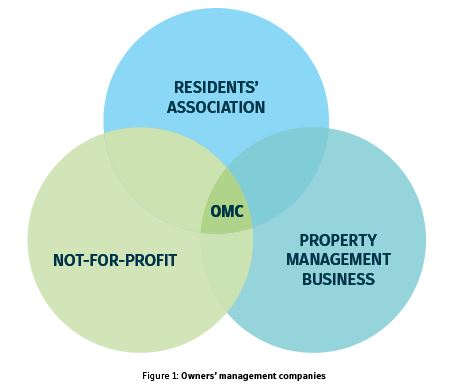

OMCs, while in form incorporated typically as companies limited by guarantee (CLG), are in substance hybrid entities. They sit at a corporate crossroads between not-for-profit companies, property management businesses and residents’ associations (see Figure 1).

Many readers will be familiar with the legacy construction and financial issues facing these companies. High-profile cases such as Priory Hall and Longboat Quay, as well as other less prominent estates, have featured in the press in recent years while corporate governance failings in OMCs receive periodic attention in court reporting.

The country’s largest OMCs have multi-million euro annual service charge budgets. And yet, the stewardship of these companies is entrusted to unpaid, untrained directors (the term “volunteer director” is deliberately avoided, as in law, there is no such thing – a director is a director). There is as yet no firm handle on the number of OMCs in the country. However, it is estimated that the upper limit is likely to be about 8,000 companies.

New report

A recent independent report titled Owners’ Management Companies – Sustainable Apartment Living for Ireland considers issues that will be familiar to those with even a passing knowledge of managed estates and OMCs. The report was jointly commissioned by the Housing Agency and Clúid Housing. The Housing Agency works with the Department of Housing, Planning and Local Government, local authorities, and approved housing bodies (AHB) in the delivery of housing and housing services. Clúid is the State’s largest AHB, managing just over 7,000 homes across the country.

The inadequacy of annual service charges, failure to provide for building maintenance (sinking) funds, and the persistent problem of mounting debtors are just some of the topics assessed. International best practice is examined, and Ontario and New South Wales are among the comparator jurisdictions featured. The future demand for high-density housing is signalled in the context of new Government policy, such as the National Planning Framework and the Climate Action Plan.

To audit or not to audit?

Recommendations for reform across a range of relevant regulatory systems are proposed. Of interest to the accountancy profession will be the recommendation for the removal of the audit exemption currently available to OMCs, most of which, as noted earlier, are incorporated as CLGs. Companies Act 2014 provides the audit exemption for CLGs. In this way, small not-for-profit companies without shareholders may benefit from a reduced financial and administrative burden. (It should be noted that under sections 334 and 1218 of the Companies Act, any one member of the CLG may in effect demand an audit.)

However, while OMCs are not-for-profit, they are responsible for multi-million euro property assets in the form of estate common areas. Considering the centrality of OMCs to property values, good title, and quality of living spaces, the value of an audit to members in terms of assurance, transparency, and governance cannot be overstated.

Finance and governance

The creditworthiness of OMCs in the context of current under-funding is also considered. Regulation over and above corporate compliance enforced by the ODCE is recommended. Dispute resolution outside of the courts is advocated, as are more cost-effective avenues for service charge debt recovery. Personal insolvency practitioners will be aware that OMC service charge debt is an “excludable debt” under the Personal Insolvency Act 2012. Only with the consent of the creditor (i.e. the OMC) may management fee balances be reduced or written off in a Personal Insolvency Arrangement.

The report’s other recommendations include mandatory training for OMC directors, the standardisation of accounts to a format prescribed for OMCs, and enhanced insurance obligations.

Reform may be some way off. In the meantime, practitioners should be aware that the Institute’s practice toolkit, Owners’ Management Company PQAs, was updated in 2018. This replaces the 2011 version. As the Institute’s product catalogue notes, and as may be recognised from sectoral weaknesses highlighted in this commentary, although OMCs can be small in size, they may be higher-risk clients. Future regulation of the sector could mitigate a number of the risks identified.

David Rouse FCA is an advisor with the Housing Agency, a director of the Apartment Owners’ Network CLG, and a director of one of the country’s largest OMCs.

LOADING...

LOADING...