John Convery discusses the important elements when creating a start-up and how you can improve its chances of success.

Entrepreneurship is actively promoted and regularly encouraged. Being a business owner can be very fulfilling but starting a business is no easy task. This is a journey where you will meet a rollercoaster of highs and lows. It is a challenging, demanding, frustrating, testing, isolating, lonely, long road on the way to – hopefully – profitability and success.

Research suggests 20% of start-ups fail in year one, just under 50% make it to year five, 66% have failed by year 10, and by year 15 only 25% are still surviving. Some businesses deemed to survive merely limp along for years, often referred to as 'the living dead'. However, with the right planning, mindset, and funding, improving start-up survival rates is achievable.

Why start-ups fail

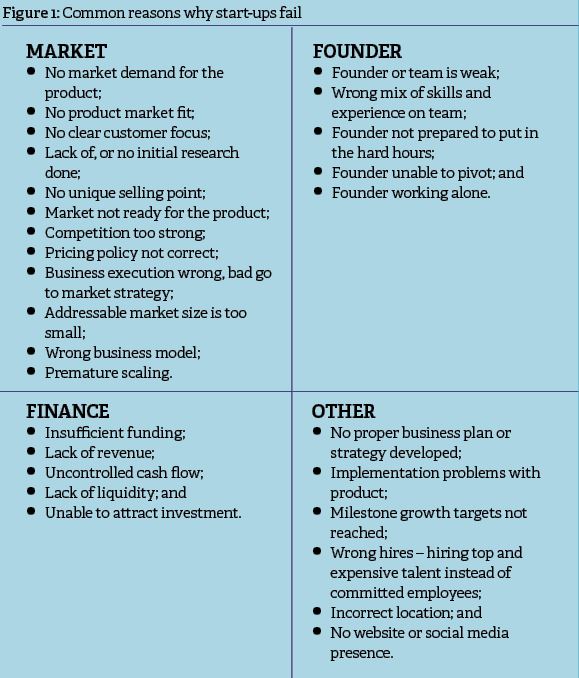

There is a myriad of reasons why start-ups fail. In my view, it is usually due to a combination of factors rather than just one. Figure 1 summarises the most common reasons start-ups fail. They are broken into four areas: market, founder, finance and other.

Improving your chances of success

To improve your chances of having a successful start-up, you must get some fundamentals right.

Sell a product/service that customers want

A key reason start-ups fail is because there is an insufficient market need for the product or service. This can be mitigated through focus on the customer from the start. You must be customer-centric before you build, design, or develop anything. Take the time to put your ideas down on paper, and then go out to customers.

- Talk to potential customers or users, listen to them, try to identify their biggest pain points or struggles. Do market research.

- Build a basic, early version of the product.

- Go back to some potential customers, get their views and feedback.

- Refine, modify and enhance your product based on the feedback.

- Go back to potential customers again, get their views and any further changes or improvements needed.

- Enhance your product again.

It is only with constant feedback and user reaction that you can improve the product and arrive at a point where it can begin to appeal to potential customers. It is a test and feedback loop. After the testing is done, you will begin to get a feel for a business model and pricing.

Create a balanced team

Find good people with complementary skills who gel with one another – preferably a designer, engineer and marketeer. Teams build companies, not individuals. Investors also want to see a team, not a single founder.

Control cashflow tightly

It’s the job of the main founder or appointed finance person to make sure the company does not run out of money and to control finances tightly.

Write a business plan

The process of writing a business plan is not an academic exercise, it is a validation exercise on the product and overall business. The business plan should corroborate whether the product and overall business has potential.

Appoint a savvy external business mentor or adviser

Their role is to ask hard questions, challenge you, objectively evaluate progress against targets set and hold you accountable. This person should not be a close relative or friend.

Is entrepreneurship right for you?

Creating a start-up is not for everyone. Like any career choice, not everyone is cut out for certain roles. It may not suit your interests, temperament, passion, or skills. The requirements or skillset for an entrepreneur are not specified, yet the skills required to be successful are rarely discussed other than in academic textbooks.

Your character and resilience will be severely tested in a start-up, especially in the early stages. Delays, disappointments, criticism, rejection, frustrations, travel, endless presentations, knockbacks and 80-hour weeks with little pay is what a founder is facing. Fundraising is arduous, where it can take six months of meetings, calls, presentations and visits to secure investment. This takes a toll on you mentally and physically, and your ability to face these knocks and challenges while remaining optimistic is difficult.

Successful entrepreneurs show some essential personality characteristics such as patience, an ability to listen, learn, accept criticism, and stay positive. They are a people person, and able to get along and deal with all types of individuals. Failure does not defeat them, and they learn from mistakes. They can take things in their stride and are willing to adjust or pivot when required. Successful entrepreneurs possess drive, ambition, and determination.

Anyone who might be considering creating a start-up should do some self-examination as part of the planning. They need to ask themselves honestly if they have some or any of the requirements that an entrepreneur needs to have. Ask yourself questions such as:

- Do I have that entrepreneurial drive and determination?

- Am I cut out for this?

- Why do I want to start a business?

You should only start a business for the right reasons. Self-indulgence, fulfilling a dream and pleasing someone else are not valid reasons.

You fail and you learn

The aim of a start-up is to solve a problem for a customer. The customer comes first. Your starting point is talking to customers, discovering their pain points, and then using that feedback.

If you are not getting good market traction, be prepared to pivot and change. If the business is still struggling to get off the ground, be prepared to disengage. This can be a difficult decision but necessary. You can always start again. Remember: you will pass failure on the way to success. A failed start-up is a valuable lesson. You fail, you learn, you start again and you do things better.

I believe it is possible to improve start-up survival rates with good planning, the right mindset, and a funding plan. If your product/service is good enough, you will always secure funding. While the risks of failure in a start-up are high, the entrepreneurial spirit will nevertheless always be alive.

John Convery FCA is a business adviser to start-ups and small businesses.

LOADING...

LOADING...