The FAE Core curriculum is undergoing significant changes in order to maintain the Irish ACA’s global reputation for excellence.

By Ronan O'Loughlin

Members and students will be aware of the significant technological changes impacting on the work and careers of Chartered Accountants. It isn’t just the technological changes that are significant, but the increasing pace of change. Against this backdrop, the Institute’s Education Training and Lifelong Learning Board (Education Board) and Exam Committees have been adapting and enhancing the ACA curriculum to meet these challenges.

This article outlines the changes to the FAE Core examination, which will be rolled out from autumn 2019. From a practical perspective, this can be viewed as a first step and will be further enhanced in the years ahead.

The journey

At a global level, the profession is paying significant attention to the impact of technology on the education needs of students and qualified accountants. Technology is impacting what we learn, how we learn and how we are assessed. The skillsets of Chartered Accountants must be further developed to cope with these changes.

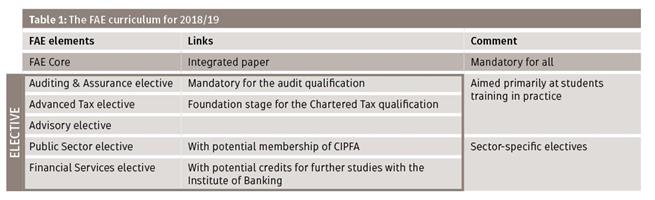

The Institute launched a new syllabus in 2018, which featured new FAE electives. These are: the Public Sector elective, which is aimed at students working or advising in this sector; the Financial Services elective, which is targeted at students training in the Financial Services sector; and the Advisory elective. With the other existing Audit and Tax electives, students now have a choice of five electives. This innovative structure recognises the changing nature of the work of the profession and in the case of those working in practice, the increasing importance of Advisory in particular.

The 2018/9 structure is summarised in Table 1. Students completing FAE must complete FAE Core and one elective. This structure is unique amongst our reciprocity partners and supports a level of pre-qualification specialisation. All electives can be completed at the time of qualification and additional electives can be completed post-qualification to support career changes.

The Education Board and the relevant examination committees are also mindful of the work currently underway with our reciprocity partners in the Global Accounting Alliance, which will frame the skillsets and requirements that will be necessary for Chartered Accountants in the future. This work will conclude in 2019 and will inform the new reciprocity agreements, which will be rolled out in the years ahead. In the meantime, the FAE Core syllabus will be further developed in anticipation of likely reciprocity developments and emerging technological developments. This will be rolled out in 2019/20.

Changes to the FAE Core syllabus

The Core syllabus is being restructured, with a reduction in modules from five to four (see Table 2). This new structure reflects a desire to create ‘space’ for the new material and to better reflect the changes in our key training firms and organisations. These changes include an increased focus on advisory work and the re-framing of audit practice. There are a number of reasons for these changes:

- Financial Reporting in terms of syllabus requirements remains as before; it is a key skill for all Chartered Accountants. The slight change in weighting reflects its importance. Assessment will take place within the Core exam and, separately, in an interim Advanced Application of Financial Reporting Principles (AAFRP) assessment;

- Strategic Management and Leadership contains the areas of strategy (analysis, choice and implementation), as before, with the addition of the Strategic Finance Management Accounting (SFMA) topics previously examined under a separate heading. In terms of the SFMA topics, the focus will be on dealing with the key strategic aspects of these topics;

- Data Analytics, Artificial Intelligence and Emerging Technologies represent new material, which reflects the current and emerging technological developments that will impact businesses and clients of Chartered Accountants. The topic covers data analytics, with particular reference to determining the data set and its integrity and the interpretation of the outcome of the data analysis. Artificial intelligence will be explored, given its significant impact on business processes. The Emerging Technologies focus specifically on blockchain and cryptocurrency developments, which are creating significant new opportunities for the processing of financial information. The aim is to ensure that newly qualified Chartered Accountants are equipped to understand these developments and their impact on their clients and employers; and

- Risk Management and Sustainability focuses on the area of audit process, risk management and internal control rather than the traditional external audit focus. Extended coverage of audit and assurance will occur in the Audit Elective. Other new topics include professional scepticism, sustainability and integrated reporting. This rebalancing reflects the evolving nature of audit and the emergence of topics that are altering the role of today’s Chartered Accountant.

Feedback received

We shared these developments recently with our students and other stakeholders, and the feedback was fully supportive. Students recognise that these developments will future-proof their careers and enhance their career prospects. One recently admitted member said: “I wish I was completing the FAE in 2020”.

These changes are just the first step in the planned evolution of our syllabus to reflect the ongoing rapid changes in technology. The education programme in 2019/20 will be supported by a suite of new learning materials.

Other changes

In addition to the FAE Core changes, a new e-assessment platform will be launched on a pilot basis at CAP1 level. The initial pilot will be conducted in 2019/20 and will be limited to the CAP1 interim assessments and Law. If successful, it will be expanded to all of CAP1 and all interim assessments from CAP1, CAP2 and FAE in 2020/21 and to all CAP1, CAP2 and FAE assessments in 2021/22.

The new platform allows students to complete their exam in an appropriate environment (including their home) with an online live moderation of their exam by an invigilator supported by artificial intelligence. This replaces the current online double entry examination and will include a new CAP1 Law paper and the Management Accounting interim assessment on the same platform.

The new platform will not only facilitate increased security and efficiencies, but enhanced student and customer service – and it is fully GDPR compliant. It will also lay the foundation for future enhancements to the Institute’s examination offering.

Conclusion

The enhanced syllabus and planned developments in FAE Core and e-assessments are significant developments that seek to retain the Irish ACA’s standing in the global business landscape. This output reflects significant work and investment on the part of Chartered Accountants Ireland and forms part of a plan of continuous enhancement.

Ronan O’Loughlin FCA is Director of Education and Training at Chartered Accountants Ireland.

LOADING...

LOADING...