A recent global compliance study of 890 senior compliance professionals in 25 countries highlights an increasing emphasis on compliance as a value creator. Mairéad Divilly analyses how compliance professionals are factoring in this shift, the benefits to business, and the challenges ahead.

Following a year of economic uncertainty arising from the COVID-19 pandemic, businesses worldwide are considering how to extract more value from their operations. The compliance function is no exception. In the past, companies tended to commoditise global compliance, seeing it purely as an overhead. More recently, there is growing evidence that businesses increasingly appreciate both the tangible and intangible values of good global compliance.

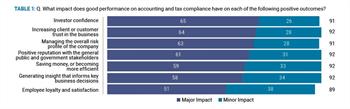

Analysis of the global compliance survey results suggests that businesses are now much clearer on the benefits and opportunities of good compliance. According to the survey, 58% of compliance professionals now view global compliance as an opportunity to create value rather than an obligation that results in a net cost, as indicated by 37% of respondents. More specifically, 65% of respondents feel that good compliance increases investor confidence, while 64% say it increases client and customer trust and 61% say it helps build a good reputation.

The benefits of good global compliance

Recognition that good compliance brings returns in the form of a stronger reputation and greater revenue is increasingly evident, particularly when we consider that compliance failures carry significant repercussions. Compliance leaders know the considerable risks of falling short, with 77% saying their business has faced accounting and tax compliance-related issues somewhere in the world during the last five years. These consequences most commonly include reputational damage, internal disciplinary action, and fines.

Pivoting from obligation to opportunity

Squeezing extra mileage out of good compliance requires businesses to shift their approach from purely tactical to one that sees compliance as a strategic investment. It requires more engagement by top executives to drive real efficiencies, increase opportunities, and become more competitive. It’s an approach not lost on our survey respondents where compliance is seen as a core function of modern businesses, with C-suites devoting more time and attention to proactively managing it. According to the survey, the executive committees and boards engage with compliance at least once a quarter in 75% of businesses, and 39% engage monthly or more.

Compliance as a commercial priority featuring more regularly on the calendars of senior leaders is validated by 44% of respondents who say the main reason decision-makers engage is to explore new insights or business opportunities. Only 28% say their senior people primarily focus on compliance to deal with an urgent issue or crisis. So again, we see compliance emerging as a business imperative that drives opportunities and not something seen as low priority or as a reaction to external developments.

Reflecting this shift of top management focus is the continued growth of compliance funding, with three in five businesses having increased funding for global compliance over the last year and 68% planning to increase funding in the next five years. Regarding specific funding projects, 73% of respondents predict investment in developing new skills and capacities within teams, while 34% see monitoring external developments in accounting and tax as significant areas for investment. However, the biggest beneficiary of funding will be new technology to achieve compliance goals and drive future improvements, with over 78% of businesses looking to invest in new accounting and tax compliance technology in the next five years and 42% planning a major new investment, according to the survey.

This focus on technology is not surprising as 39% of respondents say effective technology is the biggest factor in meeting their compliance goals today. In addition, 45% say new accounting and tax compliance technology will be the most significant factor in the compliance function’s improved performance in five years.

Of those who plan to invest in technology, 49% of compliance leaders say artificial intelligence (AI) and machine learning (ML) are their biggest priorities for investment in the next five years. Robotic process automation (RPA) and blockchain are the top priority for 25% and 24%, respectively. Regarding specific compliance function technology-related investments, 38% state that tax compliance will be their priority, while 28% plan to explore the potential of risk management tools.

Navigating the challenges ahead

Despite this shift to global compliance being viewed as a strategic investment, companies face significant challenges in developing a strategy that takes them to the next level. While 82% of respondents express a high level of confidence in meeting compliance obligations now and in the near future, there is an acknowledgement that the increased complexity of tax rules, new compliance legislation, and the aftermath of COVID-19 will test abilities and compliance functions to the max.

According to the survey, some 38% expect the ongoing impacts of the pandemic and increased complexity of compliance to be the two toughest challenges ahead. Meanwhile, 36% expect new legislation in the countries they already operate in to be one of their biggest challenges and 35% cite expansion into new countries. Political disruptions such as those connected to Brexit are also a factor, but are seen as a less likely disruptor with only 23% of respondents citing it as one of their most pressing challenges.

Challenges compliance leaders expect to face

In contrast, COVID-19 has raised new global challenges with over 75% of compliance leaders saying it has had an impact. The biggest challenge here is remote working, with 52% of respondents citing moving to home environments for work, particularly when in a different country to their employer’s location, has increased compliance needs, adding more pressure on the tax and accounting compliance functions.

There is also an acceptance that new legislation and standards are leading to stricter compliance. Over the last few years, compliance reporting obligations not only doubled and sometimes tripled in size, but changes have been complex and fast-moving. As well as seeking the help of experts, the survey highlights that, as discussed above, businesses are investing in technology to leverage compliance functions and meet the need for real-time reporting obligations. While these are welcome improvements, the rise in cybercrime presents an additional risk that needs to be factored in when introducing any technology.

Nor are automated and integrated compliance tools risk-free. Machines and algorithms are only as good as the information they are fed. Lack of knowledge remains a significant challenge in meeting compliance obligations, with 42% of respondents citing the need to develop the knowledge and skills of their compliance teams. The combination of skills shortages and the introduction of new technology can often add a new and unexpected layer of risk to the compliance function.

Pockets of success lead the way forward

The study does, however, highlight pockets of success in navigating the challenges of global compliance. COVID-19, for example, is seen as having a positive impact on individual employees by giving them more flexibility and forcing compliance leaders to become more vigilant.

Additionally, while not a new phenomenon, more companies have begun to surpass legislative requirements on tax transparency. Over two-thirds of organisations (70%) voluntarily publish more than the law requires, 45% choose to publish some extra information, while a quarter publishes extensive, detailed information well above what is required by law. Tax transparency is now seen as a microcosm of the broader compliance story. Over one-third (36%) of compliance leaders cite building trust with tax authorities, politicians, and regulators as a key benefit of publishing extra information about the taxes their business pays. Plus, a third say improving their organisation’s public reputation is a crucial benefit of enhanced tax transparency.

A further measure we see implemented by businesses that goes above and beyond is the inclusion of compliance strategies in annual reports. This sends a strong message to regulators and clients that can help improve company reputations.

Looking ahead, we can expect tax transparency to evolve and measures like publicly available country-by-country reporting to become the norm. While large multinationals are likely to take the lead, tax transparency appears high on the agenda of all businesses irrespective of size and location, according to the survey.

The global findings demonstrate that compliance professionals are also aware of the future direction of travel. Compliance-related demands on businesses will increase, leading to the dedication of more resources to meet compliance goals. At the same time, over half of businesses expect meeting compliance requirements to be more challenging in the future.

Next steps

In terms of the next steps, businesses should review and refresh their organisational setup and compliance functions to adapt to changing circumstances. This will include focusing on regulation as well as management processes to reduce risk and seize opportunities. Anticipating new laws and having the ability to react is vital. In particular, firms must understand their limitations to mitigate the risks linked to compliance.

Nurturing agility will allow leaders to anticipate changes so their teams can keep up with global compliance rather than being hindered by it. The return on compliance investment may often be indirect and hard-won, but it should never be underestimated given its importance to growing businesses. Technology can also help companies with global compliance, but the development of skills and knowledge has to be addressed simultaneously. Using internal and external expertise to find the right balance between humans and technology is essential.

With over a third of international respondents citing a more complex global compliance landscape as a significant challenge over the next five years, it’s clear that increased complexity will be a feature for years to come. As a result, businesses planning to expand globally will need to be secure in their ability to comply with employment, taxation, payroll, and company legislation in other jurisdictions.

As the study demonstrates, when global compliance is done well, it builds investor confidence, increases client and customer trust, and shapes a positive reputation with the outside world. Shifting compliance from an obligation to an opportunity is something all businesses should now explore.

Mairéad Divilly is Lead Partner, Outsourcing and Compliance Services, at Mazars Ireland.

LOADING...

LOADING...