The experiences of the first wave of entities preparing CSRD sustainability statements hold important lessons on the complexities of the double materiality assessment.

Gareth Martin, Jennie Kealey and Luke Bisson delve into the details

Some of the largest entities in Ireland are in the process of issuing their first mandatory sustainability statement under the EU’s Corporate Sustainability Reporting Directive (CSRD). They are part of the first wave of reporters following transposition of the CSRD into Irish law for accounting periods beginning on or after 1 January 2024.

To identify sustainability information for disclosure, an entity is first required to complete a double materiality assessment (DMA) to determine material impacts, risks and opportunities (IROs) in relation to environmental, social and governance (ESG) matters.

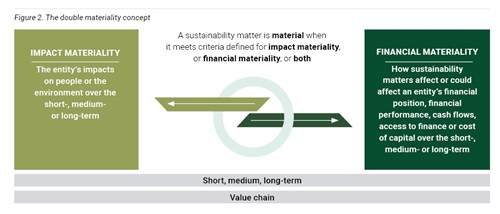

Double materiality is a new concept aimed at enhancing the existing understanding of financial materiality already familiar to accountants. It extends financial materiality considerations to encompass an understanding of both the entity’s impact on the environment and society, and the impact of sustainability matters on its own prospects, performance and position—i.e. double materiality considers both inside-out and outside-in perspectives.

The DMA process must comply with the requirements of the European Sustainability Reporting Standards (ESRS), as this is one of the components of a CSRD limited assurance report under International Standard on Assurance Engagements (Ireland) 3000 Assurance Engagements Other than Audits or Reviews of Historical Financial Information - Assurance of Sustainability Reporting in Ireland (ISAE (Ireland) 3000). ISAE (Ireland) 3000 is the assurance standard that has been adopted in Ireland for sustainability statements prepared under the CSRD.

An entity’s CSRD reporting is dependent on a robust DMA output. This is the foundation of the sustainability statement. Here, we offer some practical insights into completing an effective DMA, drawn from our experience supporting clients in this area.

Overview of the DMA process

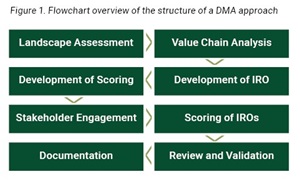

The ESRS do not mandate how to conduct a DMA and, accordingly, each entity should apply judgement to design a DMA process that complies with the ESRS. Figure 1. shows one potential approach to the DMA process.

The DMA is comprised of the two interconnected assessments of impact materiality (ESRS 1 3.4) and financial materiality (ESRS 1 3.5). Figure 2 illustrates the double materiality concept.

DMA: illustrative examples

Some high-level illustrative examples of sustainability IROs are as follows:

- Impact (positive): Actual positive impact on the environment through adaptation of manufacturing facilities to use renewable energy sources.

Impact (negative): Potential negative impact on the working conditions of workers in the value chain through contracting of suppliers in geographies with sub-standard labour laws.

- Risk: Risk of increased costs in the form of fines from non-compliance with wastewater disposal regulations.

- Opportunity: Opportunity to increase revenues from sustainability conscious customers through development of biodegradable products.

Key practical DMA considerations

Some practical considerations should be factored into the DMA process as required by the ESRS.

1. Disaggregation of the assessment

The appropriate level of disaggregation must be determined before beginning the DMA process.

The assessment may be disaggregated by business division, country of operation, subsidiary, significant site or significant asset (depending on the nature of the entity) in order to effectively identify IROs at the correct level of granularity and assess their materiality.

For example, groups must consider whether the DMA should be performed centrally at the group level, or at a disaggregated level.

2. Stakeholder engagement approach

Stakeholders include key actors in the value chain, such as suppliers, employees and customers, but can further comprise groups such as indigenous communities and silent stakeholders, such as nature. Therefore, while conventional methods of engagement like surveys, interviews and workshops are commonly used, it is also important to consider alternative approaches. This might include analyses of ecological, pollutant or geographical data. Engagement may also be indirect, through stakeholder representatives or subject matter experts.

Stakeholders should only be engaged in the assessment of topics where they have the appropriate experience and/or expertise required to provide accurate and reliable input. They may be mapped to specific IROs on the longlist to facilitate the provision of IRO inputs, where appropriate, to their position in the value chain.

3. Value chain boundary

When performing the value chain analysis step of the DMA process, management should determine the point or “boundary” in the value chain up to which information should be collected. If this boundary is not effectively defined during the DMA, there is a risk that IROs related to components of the value chain will not be identified. Consequently, value chain information may not be presented completely in the sustainability disclosures.

For example, if only first-tier suppliers are considered as part of the value chain, the impacts of second- or third-tier suppliers connected with the entity’s operations may be overlooked in the DMA, even though they are within the scope of impact materiality.

4. Material financial effects

Sustainability risks and opportunities are often drafted without properly considering their material effects on financial position, financial performance, cash flows, access to finance or cost of capital—or evaluating their consistency with the information disclosed in the financial statements. Likewise, it is common for management to only consider and score the likelihood and magnitude of a risk or opportunity, even though ESRS 1 stipulates that it is the likelihood and magnitude of the financial effects that should be assessed.

5. Dependencies on natural, human and social resources

Risks and opportunities derive not only from impacts, but also from an entity’s dependencies on natural, human and social resources. It is therefore important for management to consider dependencies as potential sources of risks and opportunities when assessing the financial effects triggered by sustainability matters. For example, a manufacturing entity should consider its dependencies on energy, raw materials, customer relationships and healthy and skilled workers, among others, when drafting and assessing the materiality of IROs on the longlist.

Dependencies on biodiversity and ecosystems should also be identified and assessed under the ESRS 2 IRO-1 requirements of ESRS E4. This includes an assessment of sites located in or near biodiversity-sensitive areas.

6. IRO scoring approach

The ESRS do not define an IRO scoring approach. However, the factors for scoring are outlined in ESRS 1 and elaborated on in European Financial Reporting Advisory Group Implementation Guidance 1 (EFRAG IG 1) Material Assessment. Scoring should also align with the entity’s existing risk management framework where possible. ESRS 1 does prescribe the use of an appropriate quantitative and/or qualitative threshold to determine which IROs are material.

EFRAG IG 1 provides graphical representations of such materiality thresholds in both columnar and matrix formats. It is important to note that this guidance is purely illustrative. Management should document the rationale supporting their choice of scoring scales and thresholds—and ensure that these decisions have undergone robust review and validation.

7. Entity-specific disclosures

When an entity concludes that an IRO is either not covered or not covered with sufficient granularity by an ESRS—yet is material due to its specific facts and circumstances—additional entity-specific disclosures must be provided to enable users to understand the sustainability-related IROs. Given that sector-specific standards have not yet been incorporated into the ESRS, it is paramount that management implements robust processes to assess potential IROs to identify any that are not aligned to the ESRS topical standards. For such topics, entity-specific disclosures should be drafted which adhere to the general disclosure requirements set out in ESRS 2 and meet the qualitative characteristics of information in accordance with ESRS 1.

DMA: useful insights

Here are eight insights that can be applied to support the DMA process:

1. The DMA process requires detailed step-by-step planning. Often, input is needed from across the organisation, particularly where a materiality assessment of sustainability information is being carried out for the first time.

2. Before beginning the DMA, an entity’s organisational structure should be appropriate for management to effectively lead and oversee the DMA process, and sufficient training should be provided. Identifying key internal stakeholders, such as members of the sustainability, environmental and financial reporting functions, will facilitate an effective assessment, as will forming a working group to co-ordinate day-to-day aspects of the DMA.

3. Validation roles for key decisions at each stage of the DMA should be clearly defined and documented. A board level steering committee could be formed for the purpose of reviewing and validating key decisions before the working group proceeds to the next stage of the process.

4. Documentation of the DMA process should begin at the inception of the assessment. This documentation should be clear, specific and detailed enough to enable assurance practitioners to understand and assess each stage of the DMA process. A centralised change log should be maintained to provide a clear and traceable trail of amendments and judgements, including their supporting rationale, over the course of the DMA.

5. Methods of engagement likely to garner the most effective coverage of views across all affected stakeholder groups should be considered. These might include surveys, interviews and workshops. A first step here might involve mapping affected stakeholder categories to sustainability matters, and prioritising different categories for engagement purposes.

6. Management should gain an understanding of the ESRS disclosure requirements, datapoints and transitional reliefs early on in the DMA process so they can effectively map material IROs to disclosure requirements and implement interconnectivity between the DMA process and disclosures.

7. When drafting the longlist of IROs and determining material sustainability matters, it is important to benchmark against disclosures prepared by peers and early reporters. This is especially pertinent in the first year of reporting, in order to effectively compare the information that is being disclosed within sectors and industries.

8. A plan for the refresh of the DMA should be agreed on from the outset. Management should implement an annual review of the DMA, comprising procedures such as a landscape review and revalidation of the DMA results. The circumstances requiring a full refresh of the DMA should be defined in accordance with the requirements of ESRS 1 and EFRAG IG 1. The frequency at which a full refresh should be performed regardless of change events must also be considered.

Planning for quality and efficiency

The DMA is a complex exercise, and each organisation will encounter its own challenges when preparing for the first year of CSRD reporting.

Despite this, there are learning points that can be applied broadly to the DMA in order to improve the quality and efficiency of the process.

Planning each step of the DMA and establishing a process compliant with the requirements of the ESRS will allow entities to develop and perform a robust DMA.

Gareth Martin is a Managing Director in Deloitte’s Sustainability Reporting and Assurance team

Jennie Kealey is a Manager in Deloitte’s Sustainability Reporting and Assurance team

Luke Bisson is a Senior in Deloitte’s Sustainability Reporting and Assurance team

LOADING...

LOADING...