The Financial Reporting Council’s updated guidance on going concern reporting offers a more comprehensive framework for assessing risk in an era of heightened uncertainty, writes Aisling Treacy

In today’s dynamic business environment, economic volatility and market disruptions have heightened the focus on “going concern” in financial reporting.

In the UK, the Financial Reporting Council (FRC) plays a key role in setting standards and regulations. The FRC has updated its guidance on the Going Concern Basis of Accounting and Related Reporting (including Solvency and Liquidity Risks) (the Guidance), replacing the 2016 edition with immediate effect.

This update reflects the evolving business environment and provides a more focused framework for UK companies, building upon the 2016 edition used by directors across many jurisdictions, including Ireland.

The Guidance calls for greater transparency and more detailed risk disclosures, especially around solvency and liquidity challenges.

Directors should adopt a forward-looking approach, assessing current and future risks to ensure companies are prepared for uncertainties, while maintaining trust with investors and stakeholders.

Guidance overview

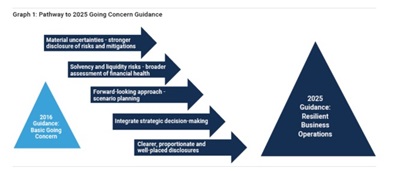

The Guidance builds upon the previous 2016 edition, expanding its scope to provide a more comprehensive framework for directors.

It is intended for all UK companies, excluding small and micro-entities, and includes companies adhering to the UK Corporate Governance Code. The Guidance consolidates various UK company law requirements, accounting and auditing standards, listing rules, the UK Corporate Governance Code and other relevant regulations.

It aims to help directors assess their company’s ability to continue as a going concern and ensure that any material uncertainties are appropriately disclosed. Disclosures should be proportional to the company’s risk profile, helping maintain transparency and supporting investor confidence.

The following section outlines the key updates to the Guidance.

Key Guidance updates

Focus on material uncertainties

The Guidance places greater emphasis on identifying and disclosing material uncertainties that could affect a company’s ability to continue as a going concern.

Directors should assess both immediate and emerging risks and outline strategies to mitigate them.

The Guidance integrates solvency and liquidity risks into material uncertainty disclosures for the first time, reflecting their importance to a company’s viability.

If doubt arises about the going concern assumption, directors must disclose related risks in line with the “true and fair view” requirement.

For the first time, the FRC recognises four potential scenarios regarding the going concern basis of accounting. Previously, the Guidance outlined three:

- No material uncertainty.

- Material uncertainty with appropriate disclosure.

- The going concern basis of accounting is not appropriate.

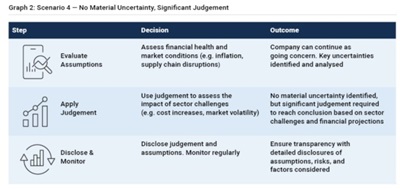

The updated Guidance introduces a fourth scenario where the going concern assumption is appropriate and there are no material uncertainties, but significant judgement was required to reach this conclusion.

Graphic 2 below outlines the decision-making process, highlighting the fourth scenario.

Broader view on solvency and liquidity

The Guidance broadens the focus on solvency and liquidity risks. Solvency refers to the company’s ability to meet its long-term obligations, focusing on business sustainability and capital maintenance.

In contrast, liquidity concerns the availability of cash and other resources needed to fund day-to-day operations.

Directors are encouraged to assess both aspects to identify potential risks and aim to manage cash flow effectively.

Forward-looking approach

A more forward-looking approach is encouraged in assessing a company’s going concern status. This involves developing detailed financial forecasts and testing a range of scenarios, from normal to extreme worst-case conditions.

Techniques such as stress testing, sensitivity analysis and reverse stress testing can help evaluate potential adverse conditions such as economic downturns, inflation, interest rates and geopolitical events.

For example, management may simulate the impact of an economic recession, sudden regulatory change or a disruption to the supply chain, to assess how these events could affect the company’s ability to continue operating.

This proactive approach may help companies prepare for potential challenges and better position themselves to navigate uncertainty.

Revised approaches to materiality and disclosure placement

The Guidance introduces detailed changes to materiality and disclosure placement. Directors are encouraged to clearly explain the assumptions, methodologies and significant judgements in their going concern assessment.

For example, if uncertainty exists over meeting debt obligations due to fluctuating interest rates, directors should outline assumptions about future cash flow projections, liquidity risk assessments and judgements regarding financing.

Disclosures should be proportionate to material uncertainties, particularly those related to financial and liquidity positions. This means focusing on significant uncertainties, such as refinancing debt or sales downturn, while avoiding over-disclosure of less significant risk.

Directors should consider the placement of disclosures to facilitate effective communication. Grouping similar disclosures reduces duplication and highlights linkages. Cross-referencing ensures key information is accessible and demonstrates consistency throughout the annual report.

Broader applicability and group considerations

The Guidance applies to a wider range of companies, including those adhering to the UK Corporate Governance Code.

Directors of subsidiary companies should assess the ability of parent companies or fellow subsidiaries to provide support for the going concern basis, considering group arrangements such as cross-guarantees or cash pooling, which can expose subsidiaries to additional risks.

Subsidiaries should disclose significant judgements about the support they receive from parent companies or fellow subsidiaries and the risks associated with group-wide going concern assessments.

Auditors’ responsibilities

The Guidance affects auditors by defining their role in evaluating the going concern assumption.

Auditors must assess whether the directors’ assumptions align with accounting standards and are adequately supported by disclosures.

If material uncertainties are not sufficiently addressed, they should challenge the directors’ judgements and ensure that material uncertainties are disclosed.

What these changes mean for management

1. Strategic decision-making

The Guidance calls for a more strategic approach to going concern assessments. Management should integrate short-term liquidity and long-term sustainability assessments into strategic and risk management processes. Directors should consider future risks, including planned investments, economic changes and market conditions.

2. Communication and reporting

Clear and transparent communication is a key focus. Companies should now disclose material uncertainties regarding going concern in a more detailed and accessible way. The company’s narrative regarding its financial health and strategic direction should align with the going concern assessment to ensure that investors and other stakeholders have confidence in the company’s prospects.

3. Risk management and scenario planning

The Guidance emphasises scenario analysis and stress testing, requiring management to develop flexible risk management strategies. Simulating extreme events, such as recessions or supply chain disruptions, helps companies understand vulnerabilities.

Questions directors may ask of management

The following questions may help guide the navigation of the Guidance. While directors may have asked some of these questions in the past, the expanded Guidance encourages them to consider a wider range of factors.

- Is the standard 12-month assessment period appropriate, or do we need a longer assessment period?

- Have we considered all material risks, including market volatility, regulatory changes and reputational risks?

- What significant judgements were applied in determining the going concern basis, and how are these disclosed?

- Have we assessed the impact of potential future disruptions, such as geopolitical risks and supply chain challenges, and incorporated forward-looking scenarios and stress tests to evaluate their effect on viability?

- Are financial forecasts and plans sufficiently robust to withstand adverse scenarios?

- Do we have access to sufficient liquidity and financing options in a crisis or downturn?

- Is the board engaged in the going concern process and actively reviewing the assumptions and conclusions?

- Have we documented the going concern process in a manner that is transparent?

- Is the audit committee involved in reviewing the going concern conclusion, ensuring that all material risks have been adequately assessed and disclosed?

- Are we effectively communicating our going concern assessment and related risks to stakeholders?

A more robust and transparent future

The updates signal a shift towards more transparent, forward-looking financial reporting, responding to the changing risk landscape, including geopolitical and economic factors.

With the transition from the 2016 Guidance to the 2025 framework, directors are encouraged to apply this modernised and robust approach to going concern reporting.

The updated Guidance offers a clearer and more comprehensive framework for assessing risk in an era of heightened uncertainty.

Directors are encouraged to take this opportunity to strengthen their strategic approach, ensuring their companies are better prepared to face future challenges and adapt to an evolving risk environment.

Aisling Treacy is a Director with KPMG Ireland

LOADING...

LOADING...