Becoming a newly qualified accountant opens the door to many opportunities. Bernie Duffy outlines what you need to keep in mind as you look for new roles

You’ve worked hard, completed all your requirements and have passed your exams. You’re nearly a newly qualified accountant.

Here are five things to remember if you are thinking of changing roles after becoming a Chartered Accountant.

1. Availability of roles

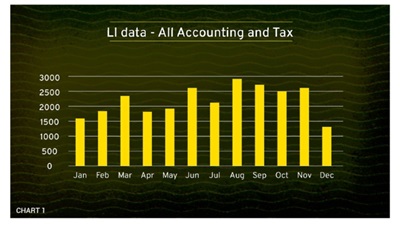

As you can see from Chart 1 (below) of job postings on LinkedIn in 2024, the quantity of finance roles advertised ebbed and flowed throughout the year, with quieter times in December, January and April.

Assuming 2025 is similar, you should be mindful of this and consider taking a more proactive approach to your search if you want to start something new in May or June.

2. Understanding the mix of roles

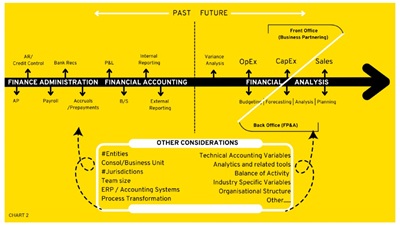

Titles in industry mean nothing without context and in many cases do not correlate between companies. Two companies can be looking to hire a financial accountant, but the nature of their roles can be vastly different. Newly qualified accountants’ roles generally fall into the following categories:

- Financial accounting: 65 percent – the balance of activity in these roles will matter. Larger companies often come with more specialised roles.

- Financial analysis: 15 percent – this isn't easy to get straight out of contract.

- Internal audit: 10 percent – this is an excellent route often overlooked.

- Other: 10 percent.

Chart 2 (below) is a visual representation of the activity in a basic finance team, along with some of the variables that come with the context of the role. The percentage of time you will spend on either side of the line in a role below is a critical consideration.

3. Hybrid working is the norm

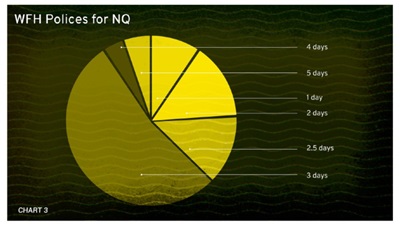

As you can see from Chart 3 (below), three days a week in the office was by far the most common work-from-home policy for newly qualified accountants in 2024, with over 40 percent of positions at this level adhering to it.

Another interesting takeaway is the lack of fully remote opportunities at the newly qualified level.

We’ve already seen a shift towards more office-based working in 2025; however, with many US multinationals calling for five days in the office, we would expect the four and five-day in-office policies to continue to increase over the coming year.

4. Rewards package

Base salary is only a part of total compensation (base + package) – want to know about total compensation for newly qualified accountants? In Dublin:

- The average salary for the second half (H2) 2024 was €65,083.

- The average bonus for H2 2024 was seven percent.

- The average pension for H2 2024 was five percent.

- The average Annual Leave Days for H2 2024 was 25 Days.

Outside Dublin, you would typically apply a 10 percent reduction on base +/- 2.5 percent, depending on location.

You may hear of people getting salaries outside this, which will usually take into account factors such as travel, higher intensity of work, a niche/specific role, or no additional benefits offered as part of the package.

These are all important factors to consider when assessing the compensation package attached to a specific role.

5. The wider economy

The jobs economy over the medium term is uncertain. As a result, we are seeing a lower volume of roles on the market compared to last year. There may be increased contract roles and likely a drop in permanent roles.

What does this mean for you, and how can you increase your chances? If you have 10 important factors you are looking for in a new role, a compromise may be needed, and maybe a need to focus on six of these factors.

This could involve taking a role in a company of interest, on a contract basis, or in a not-so-ideal location.

This may not be a market where you can have it all, but there are still opportunities to be had.

Bernie Duffy is Senior Associate of Recently Qualified Accountants, Leinster at Barden

LOADING...

LOADING...