Recent European heatwaves have highlighted the impact climate change has on society and the economy. Susan Rossney explores the challenges facing Irish businesses when taking steps to tackle the crisis

Recent severe heatwaves in continental Europe have shown how the effects of global warming are coming ever closer to home. Forced migration, drought, forest fires and biodiversity loss are some of the many ways climate change will impact Irish society.

Its impact on the economy will be acute, affecting everything from the health and wellness of employees to the cost of raw materials, scarcity of resources and supply chain disruption.

Ireland and climate change

Climate change poses risks to humans, nature and Ireland as a nation.

Ireland is legally bound to meet ambitious national and international climate targets. According to the Climate Change Advisory Council (CCAC), an independent advisory body, Ireland will not meet the climate targets it has set for itself in the first and second carbon budget periods. The Environmental Protection Agency’s (EPA) provisional estimates on 2022 greenhouse gas emissions show that Ireland already used 47 percent of the carbon budget for 2021–2025 in the past two years.

An annual reduction of 12.4 percent is now required for each of the remaining years if Ireland is to stay within budget.

However, as emissions fell only 1.9 percent in 2022, this has been described as “extremely challenging” by the EPA.

It is clear that action is required across all sectors of the economy and society, including:

- Mitigation: reducing activity that causes climate change, like burning fossil fuels (coal, oil and gas); and

- Adaptation: making changes to deal with the effects of climate change, from operational changes to cope with rising summer temperatures or winter flooding to factoring in the risk of developing stranded assets and increased carbon tax liabilities.

Ireland’s perception of climate change

According to Climate Change in the Irish Mind, EPA research conducted in 2021, most Irish citizens share a desire for action on the climate crisis.

However, other EPA research has found that our emissions of greenhouse gases (GHGs) continue to rise.

Environmental Indicators Ireland 2022, published by the Central Statistics Office (CSO), shows that Ireland’s 2022 emissions were 11 percent higher than in 1990.

Enterprises contributed an estimated 12.7 percent to Ireland’s overall emissions in 2018, according to the Climate Action Plan 2023. Although this is less than the contributions of other sectors, there remains a need for Ireland’s enterprises to take action to reduce their emissions.

However, a 2022 national survey of 380 SMEs and larger enterprises across industry and service sectors by Microsoft and University College Cork found that Irish businesses are underprepared to make the necessary changes to transition to a net zero future. According to the study, 86 percent have no commitments or targets to decarbonise.

Barriers to action

In the face of evidence of climate change – and Ireland’s willingness to take action – what is preventing Irish businesses from responding to the crisis?

As an issue, climate change is complicated, abstract and overwhelming. Multiple interdependent factors cause it, and it is nearly impossible to avoid contributing to it in our daily lives. Buying products, driving a car or taking a flight for a foreign family holiday (full disclosure: I’m just back from one) all add to the overall problem.

The solutions to the climate crisis are also interdependent and complicated. The positive changes we can make as individuals can feel insignificant, especially compared with large countries’ continued pollution.

The European Commission’s Annual Report on European SMEs 2021/22 – SMEs and environmental sustainability identified access to finance, limited expertise and skills, and regulatory and administrative barriers among the challenges facing SMEs in particular. Businesses that want to take climate action often have limited time, cash flow, resources and support (both financial and non-financial) to take action.

Knowledge is also a barrier. Many professionals qualified at a time when climate change was not identified as a business risk. They now find themselves having to skill up mid-career in an area that is famous for changing frequently.

Finally, many citizens and businesses are still struggling with crises related to COVID-19, inflationary pressure, supply chain disruption and high energy costs. Staying afloat is a crisis in itself.

Firms, particularly SMEs, focusing on the practicalities of running a business, paying staff and grappling with cash flow and costs are more likely to see climate action as the responsibility of governments or, at the very least, large corporations rather than them.

On top of that, climate discussions are often politicised. They are regularly reduced to a ‘them vs us’ polarised debate in mainstream media rather than discussing how everyone can work together to deliver solutions.

Threats and opportunities

For businesses, climate change presents both threats and opportunities.

Threats

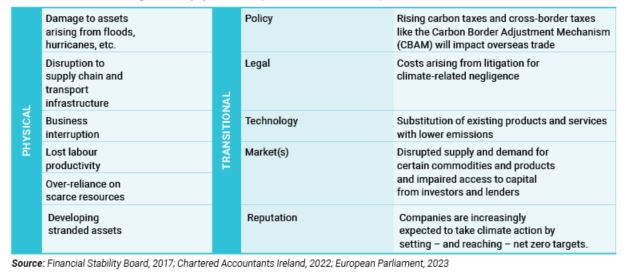

The threats have been categorised as physical risks (both ‘acute’ and ‘chronic’) and transitional risks.

Opportunities

Taking action on the climate crisis enables businesses to restore lost ecosystems, improve air quality, community health and well-being, and avail of the opportunity to make a lasting positive impact. There are additional advantages to consider:

- Reduced costs – the Sustainable Energy Authority of Ireland (SEAI) estimates that the average SME can save up to 30 percent on its energy bill by becoming more energy efficient (improved heating and lighting, lower maintenance of electric vehicles, efficient water and materials management and using recycled materials with a lower climate impact all contribute to lower costs);

- Reduced reliance on exposure to fluctuating oil and gas prices from switching from fossil fuels (coal, oil and gas) to renewable energy sources;

- Reduced exposure to carbon tax, which is increasing €7.50 per tonne to €100 per tonne in 2030;

- Access to grants, allowances and tax reliefs;

- Improved access to capital and finance from investors and lending looking to ‘green’ their portfolios; and

- A competitive edge in attracting talent, clients and customers.

Steps to climate action

Businesses looking to take action on the climate crisis can take several steps:

- Build your knowledge. There are many resources out there, several provided by the Government and Chartered Accountants Ireland.

- Begin measuring emissions with tools like the Government’s Climate Toolkit for Business.

- Consider an internal energy audit to find ways of reducing your carbon footprint. SEAI maintains a list of registered energy auditors and offers SMEs a €2,000 voucher towards the audit cost.

- Consider setting up an internal environment and climate impact team to devise a decarbonisation plan.

See also the

Sustainability Glossary in the Sustainability Centre of the Chartered Accountants Ireland website.

For more, see

www.charteredaccountants.ie/sustainability-centre/sustainability-home

Susan Rossney is Sustainability Officer at Chartered Accountants Ireland

Reporting and climate change

The Corporate Sustainability Reporting Directive (CSRD) is an EU Directive requiring certain companies to disclose information on sustainability-related impacts. It proposes significant changes to how entities report on their business’s environmental, social and governance (ESG) impacts. These changes will affect many enterprises – directly and indirectly.

Businesses ‘in scope’ of the CSRD are required to consider their supply chain when reporting on sustainability matters. This will mean that companies not in scope that form part of a supply chain may be asked to provide climate-related information by companies in scope. Small companies should prepare for this and have a mechanism to measure and disclose their carbon emissions.

For more on the CSRD, see the

Chartered Accountants Ireland Technical Hub.

Dee Moran is Professional Accountancy Lead at Chartered Accountants Ireland

LOADING...

LOADING...