The UK’s Financial Reporting Lab recently spoke to companies and investors about what they wanted from cash disclosures, outside of the cash flow statement. This is what they found…

By Thomas Toomse-Smith

It has been said that investing is as much art as science. Numbers can tell you so much, but at the heart of every investment decision is a story – either that which the company tells or which investors interpret for themselves.

But to allow investors to interpret that story correctly, they need disclosures that help them better understand the generation, availability and use of cash. This allows them to make an assessment of management’s historical stewardship of a company’s assets, as well as support analysis of future expectations.

Cash and flow

The core disclosure that supports investor needs on cash is often conceptualised to be the cash flow statement. However, while it clearly provides information about the flow of cash, does it do a good job of explaining how that cash is, and (more critically) will be, generated and used?

Our discussions with investors suggest that the disclosures that help answer this question are often provided outside of the cash flow statement, and perhaps outside of the annual report completely. Our project focused on this supplemental, but nevertheless fundamental, set of disclosures; disclosures that are principally about the sources and uses of cash.

What do investors want?

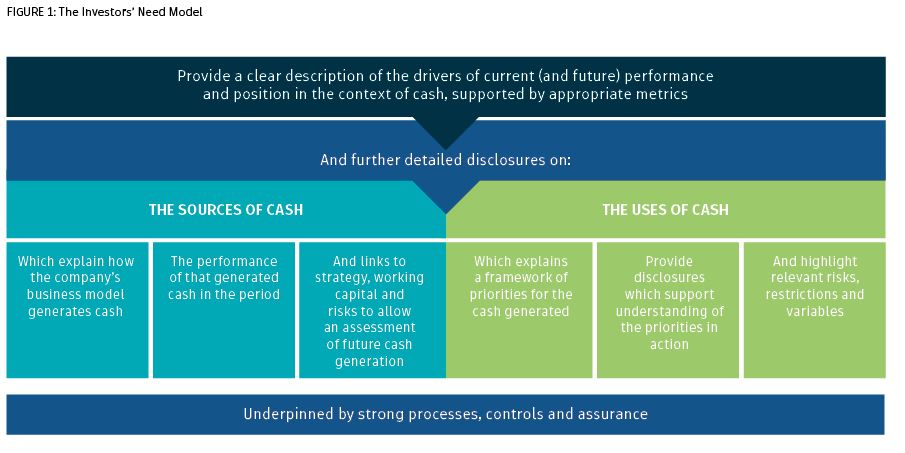

Our discussions with investors concluded that what they want, at a high level, is an overall direction on companies’ cash position but that this should be supported by further details. We have summarised investors’ needs in the model outlined in Figure 1.

A focus on drivers

Companies note that communicating their strategy and performance are essential objectives of their investor communications. However, for many companies, their attention is on a number of performance-focused metrics (such as profit or adjusted profit) with cash metrics featuring as a supporting, rather than a leading, metric. While companies often do a good job of explaining some aspects of their wider performance, cash metrics and cash generation are often not fully explained. This wider cash story deserves better explanation.

Both numbers and narrative are crucial for investors. However, the most effective disclosures are those where numbers and narrative are combined in a way that shows how future cash generation is underpinned by current cash generation. Two ways in which we saw companies trying to communicate this was through better disclosure around selection and use of key performance metrics (in line with the practices suggested in our recent KPI report), and through the use of narratives (that bring all the cash-related elements together).

A focus on sources of cash

Understanding the link between the operations of a company and its generation of cash is a key objective for investors. However, it is something that is not always easy to do from the information a company discloses. Investors that participated in our project noted that this lack of clarity is prevalent and that it can be challenging to understand how the operations of businesses are generating cash. Key areas where further enhancements would be welcomed include working capital and groups.

While the generation of cash is important, to fully understand the health of a business, investors also need to understand their approach to working capital. Disclosures that provided more clarity were narratives about differing working capital requirements, cycles and metrics within different elements of a group, and disclosures detailing less common approaches to financing such as factoring or reverse factoring.

While investors are interested in the overall capacity of a group to generate cash, it can also be important to understand where within the group the cash was generated, especially for credit investors. This is an area where there remain limited examples of good disclosures in the marketplace, but an area where investors were keen to obtain more information such as how much capacity was within the group and how the group manage capital and cash between its subsidiaries.

Uses of cash

Once investors have considered how a company generates cash, and the quality and sustainability of that generation, they then want to understand what a company intends to do with the resulting resource.

While many investors feel that, in general, disclosure about the use of cash is relatively well-reported, they would like more information that supports their assessment of the future use of cash – namely, understanding priorities and the risks attached to them.

Setting priorities for generated and available cash

At its simplest level, capital allocation is a balance between maintaining and growing a business. However, there is a significant nuance in how these various priorities are balanced within any business and at any point in time. Differing considerations of the relative priorities will lead to a very different view when assessing a company. That is why information about how companies prioritise different stakeholders is useful. Many businesses have therefore taken to creating more formal disclosure, often in the form of a capital allocation framework. This approach is particularly popular with companies that are launching a new or refreshed strategy. While the disclosure of a framework often provides only a high-level picture of a company’s allocation priorities, it can serve to focus investor and management conversations on key aspects of the business. As such, investors often welcome such disclosure.

Priorities in action

Once investors are clear on management’s priorities, they then want information that supports their understanding of how those priorities are represented in the period, and how current decisions might impact future flows. Detail regarding capital expenditure, dividends and other returns are critical to achieving this understanding as they help establish whether management actions are aligned to the priorities.

Variabilities, risks and restrictions

To properly assess the future potential upside of a business, investors need to be able to assess the downside. Investors understand that returns are variable and should reflect the changing focus and priorities of the company, the call of other stakeholders and the availability of resources. Investors therefore value information that helps them understand the potential uncertainties and management’s reaction. When thinking about future availability of cash, they need information on:

- Variability of future outcomes: how does the company consider the range of possibilities for future cash use and how does that feed through to the prioritisation of decisions?

- Risks: what is the link between the risks facing the company and the outturn in cash generation, use and dividend?

- Restrictions: are there any restrictions on current or future cash, either through capital or exchange controls, availability of dividend resources or other items?

Concluding message

Overall, investors are not seeking to overburden preparers but they do want preparers to focus disclosure on the areas that are most fundamental to their investment story.

The full Lab report is available on the Financial Reporting Council’s website, and gives more insight and examples.

Thomas Toomse-Smith is Project Director at the Financial Reporting Council’s Disclosure Lab.

LOADING...

LOADING...