The new auditing standard on estimates will have a significant impact on management as well as auditors. Brian MacSweeney reports.

The revisions to ISA (Ireland) 540 (Revised) will have important implications for chief financial officers, financial controllers and management responsible for financial statement preparation and the determination of accounting estimates. Its impact may be felt outside finance functions where others contribute to the calculation of estimates – for example, valuation specialists, taxation teams or pension specialists. It will also give rise to additional considerations for audit committees recommending financial statements for approval.

What are the implications?

The new standard requires the auditor to perform additional understanding and risk assessment procedures over estimates, along with other new requirements. This means that:

- more time is needed from management to help the auditor perform these procedures;

- management will need to articulate their processes and controls around estimates better;

- there will be more dialogue between auditors, management, and those approving financial statements about the critical aspects of estimates; and

- there will be a better and more robust audit approach to auditing accounting estimates in the forthcoming financial reporting cycle.

Why was the standard revised?

The preparation of financial statements involves many different elements, but the preparation of estimates is perhaps more complex than others. Estimates are monetary amounts (recognised or disclosed), which are a fundamental part of entities’ financial statements. They are subject to estimation uncertainty due to inherent limitations in knowledge or data, and as a result, there may be a wide range of measurement outcomes for any estimate. In forming estimates, management apply methods or models where they make assumptions and use data. They exercise judgement involving complexity and subjectivity when measuring the estimate. Due to the nature of this process, estimation is susceptible to material misstatement, and for the users of financial statements, they are the main focus.

Over time, accounting estimates have become more prominent and visible in financial statements, garnering additional scrutiny from readers. This is caused by increasingly complex business environments (now made more complicated due to the COVID-19 pandemic) and the introduction of new accounting standards over the last number of years. The previous version of the ISA 540 standard was written before these changes and they, along with challenging audit inspection findings, meant that a new framework was needed for auditors to robustly audit estimates. In response to these challenges, the Irish Auditing and Accounting Supervisory Authority (IAASA) issued ISA (Ireland) 540 (Revised).

What is the aim of the new standard?

The new standard aims to:

- address changes in financial reporting standards and business environments that make estimation more difficult;

- enhance auditors’ professional scepticism, considering recurring audit inspection findings criticising the quality of audits of accounting estimates; and

- Realise public interest benefits through better two-way dialogue between the auditor and management concerning estimates.

What is new?

Enhancements contained in the new standard include:

- Enhanced risk assessment: the standard requires a robust risk assessment of estimates. The aim is to heighten auditors’ understanding of processes and controls around the identification of estimates and the determination of the related monetary amounts. This risk assessment is performed at a granular level and focuses on the models, assumptions, and data used to determine the estimate. The assessment is made with reference to inherent risk factors, including the complexity of the estimate, its subjectivity, and estimation uncertainty.

- Scalability of testing approach: the testing approach options in the old ISA 540 are maintained. These include testing management’s calculations of the estimate, developing an independent estimate, or using events after the year-end as audit evidence for the estimate. However, the new standard focuses on aligning the level of procedures performed to the assessed risk. This gives the standard scalability, where the level of audit effort is dictated by the complexity and risk associated with the estimate.

- Professional scepticism: ISA (Ireland) 540 (Revised) has several provisions designed to enhance the application of professional scepticism. These include:

- o A requirement to design and perform further audit procedures in a manner that gives more focus to evidence that may be contradictory.

- o A requirement to evaluate the audit evidence obtained regarding the accounting estimates, including both corroborative and contradictory audit evidence.

- o Changing the language in the standard to use purposeful words like 'challenge', 'question', and 'reconsider', thus reinforcing the importance of exercising professional scepticism.

- Disclosures: there are enhanced requirements to assess whether the estimate disclosures are “reasonable”.

- Communication and representations: there are new requirements to consider when communicating with those charged with governance. There is a requirement to request written representations regarding the reasonableness of methods, significant assumptions, and the data used.

What is the impact on management?

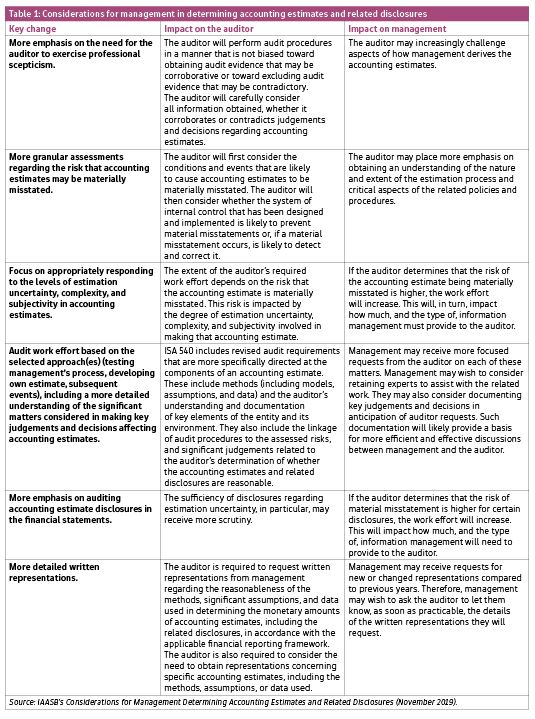

Table 1 sets out the key changes required by ISA (Ireland) 540 Revised and their impact on auditors and management. This summary was prepared by Chartered Professional Accountants Canada and was adopted by the IAASB (International Auditing and Assurance Standards Board) for its client briefing document dated November 2019.

What happens after implementation?

The standard-setters intend to undertake a post-implementation review after the effective date of ISA (Ireland) 540 (Revised) to see if the revised standard has achieved its intended objective. They will focus on whether the standard is sufficiently scalable and whether it enhances the exercise of professional scepticism.

First impressions

Having read the new standard and prepared illustrative audit work papers to see it in practice, it is clear that this is a significant change to how auditors will approach the audit of estimates. The key message is that auditors will need to prepare early to perform a detailed understanding and risk assessments procedures. Management will have more to do to help the auditor in their risk assessments, but early communication and engagement between the auditor and management will ensure successful adoption.

In addition to the above, due to the COVID-19 pandemic, developing estimates for expected credit losses, going concern analysis, and related disclosures, in particular, is more challenging. A focus on the audit of estimates is therefore paramount.

Overall, in a financial reporting environment that is evolving due to changing business environments and accounting frameworks, ISA (Ireland) 540 (Revised) provides audit practitioners with a good basis to audit estimates and to serve the public interest by fostering audit quality.

Brian MacSweeney ACA is a Director at KPMG Ireland.

LOADING...

LOADING...