The audit of less complex entities

IAASB Standard issued

The International Auditing and Assurance Standards Board (IAASB) issued the new International Standard for the Audits of Less Complex Entities on 6 December 2023.

Where it is adopted or permitted the standard is effective for audits of financial statements for periods beginning on or after December 15, 2025, (i.e. 2026 calendar year audits) with early adoption being permitted and encouraged.

The standard can be downloaded from the

IAASB.

The standard has not yet been adopted for use in Ireland or the UK.

New support material from IAASB

To support adoption and implementation of this new standard, during the first half of 2024 the IAASB will issue additional materials.

- Q1 2024: Supplemental guidance on the Authority

- Q1 2024: Fact sheet on adoption

- Q2 2024: Supplemental guidance on Reporting

- Q2 2024: First-time implementation guide

All new materials will be included on the IAASB.

New video series from IAASB

The IAASB has also launched a series of videos exploring the benefits of the LCE compared to the full suite of standards and a closer look at some of the features and the structure of the standard.

Background

The consultation on the proposed International Standard on Auditing of Financial Statements of Less Complex Entities closed on 31 January 2022.

There has been growing debate over the increasing complexity and voluminous nature of the International Standards on Auditing (ISAs) in particular in recent years the cost and value of an ISAs audit has been causing concern for many members and their clients.

The size and nature of the Irish economy means that we have a wide mix of businesses and, in common with the rest of Europe the threshold for a statutory requirement for audit has grown over recent years. However the audit threshold in Ireland remains at a significantly higher level than many other European countries resulting in many relatively small businesses still coming into the audit net.

With this background we welcomed the opportunity to review, discuss and debate the development of a standard that aims to serve entities outside large complex multinationals.

We are supportive of the aims of IFAC and the globalisation of standards which we believe have successfully raised standards internationally. Piecemeal developments across the world in our view serve no purpose so we welcome the IAASB initiative to produce a standard which can be adopted across the globe.

A working party from the Institute's Audit and Assurance Technical Committee reviewed the draft standard and application material in detail and submitted a response to the IAASB consultation.

Background to the proposed standard:

Key matters

- The proposed standard for LCEs is intended to be a stand-alone self-contained standard, mixing between the LCE standard and the full ISAs will not be permissible.

- The audit opinion issued under the LCE standard would still be a reasonable assurance opinion. The IAASB considered what the appropriate level of assurance would be for an audit under the LCE standard, and the view was that the standard should have requirements that would result in a reasonable assurance opinion. It was decided that it needed to clear in the auditor’s report which standard(s) have been used so that users of the financial statements have transparency as to which standards have been applied in conducting the audit.

The three most significant areas of change outlined by the IAASB are as follows:

- Accounting estimates

- Where the entity uses a service organization for processing transactions

- Management amendments to the financial statements after the date of the auditor’s report

Potential issues for consideration

- Group audits – consideration as to whether group audits should be allowed apply the LCE standard in certain circumstances (currently prohibited under the LCE ED). The IAASB are open to potentially allowing group audits under the LCE standard, Section 5 of the explanatory memorandum of the ED discusses this matter.

- Training considerations – firms may face education challenges with two sets of auditing standards, however it should be broadly similar to the situation with IFRS vs FRS 102.

Proposed use:

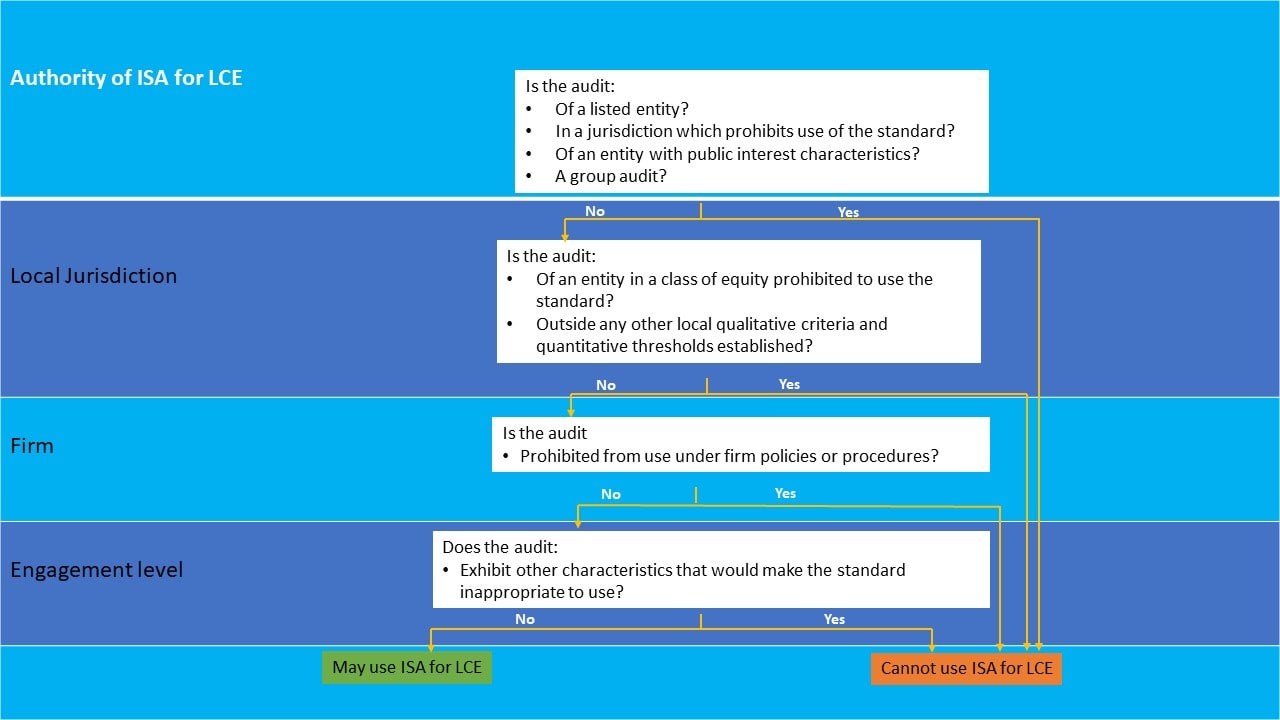

The IAASB have included a decision tree in the exposure draft which outlines which entities can and cannot apply the LCE standard:

Chartered Accountants Ireland can accept no responsibility for the content on any site that is linked to from the Institute website. Links are provided in good faith for the potential support of members and students.

LOADING...

LOADING...